Invest

in your child’s future

with my529

Even small sums set aside regularly over time help make higher education more affordable. Each dollar saved is a dollar you don’t need to borrow and repay with interest.

my529 can help everyone save, even if you’re not a Utah resident.

Introducing incentiFive℠ — a new savings program for Utah families

As a Utah parent of a newborn, you have a unique opportunity to plan for your child’s future: By contributing just $100 a year for five years, you can unlock up to $929 in special incentive contributions to help your little one soar toward their academic dreams.

Getting a tax refund?

Think about paying it forward with my529!

It’s always a good day to get a tax refund — but this year, consider using some of that cash to contribute to a my529 account.

Plus, if you’re filing taxes in Utah, you can even choose to put a portion of your refund directly into your my529 account when filing your taxes. In your tax preparation software and on Utah tax form TC-40, enter the amount of the refund you decide to send to your my529 account(s).

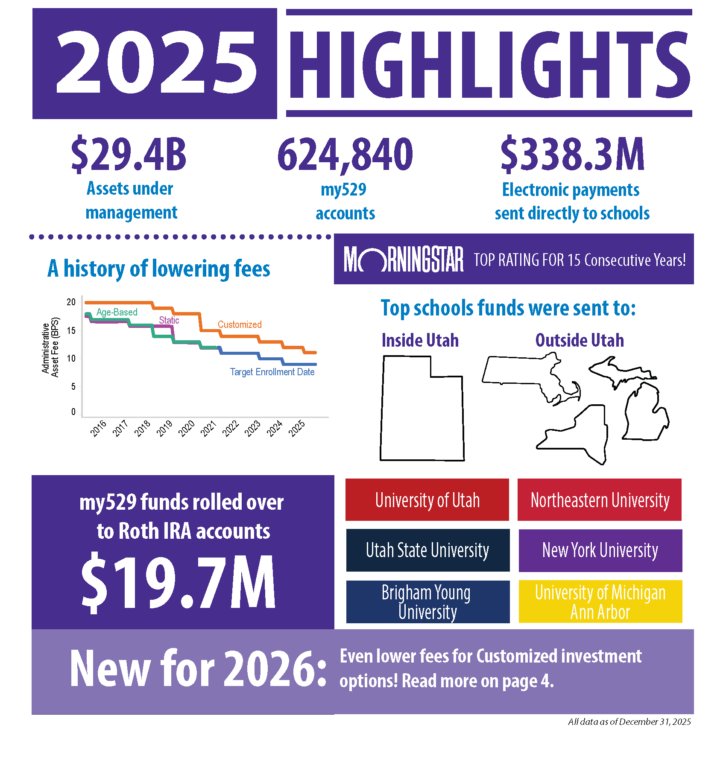

my529 earns Morningstar Gold for 2025

For 15 years, my529 has been named annually as one of the country’s top 529 educational savings plans by Morningstar, a leading industry analyst. One of only five 529 plans nationwide to earn the Morningstar Analyst Rating™ of Gold for 2025, Utah’s plan has received consistent recognition for its investment option design, experienced investment team and low fees.

Calculate your college savings needs

my529 is working with Invite Education to provide a financial calculator to help you plan out a strategy for higher education costs. Just plug in your information and future goals. Change variables on which schools your beneficiary might attend or how much you want to contribute to savings on a regular basis, then view your results. You can explore multiple future possibilities. After you’ve made your calculations, you can print out a personalized report.

The latest from the my529 blog

-

Did you know that my529 helps to run charitable Children Savings Account programs?

my529 has created over 12,000 CSA accounts with nonprofit, government and education organizations headquartered in more than 15 states. These

-

Cutting costs amidst rising tuition

Higher education benefits can extend beyond monetary earnings — but they also require significant investments of time and money. Here

my529 plan in action

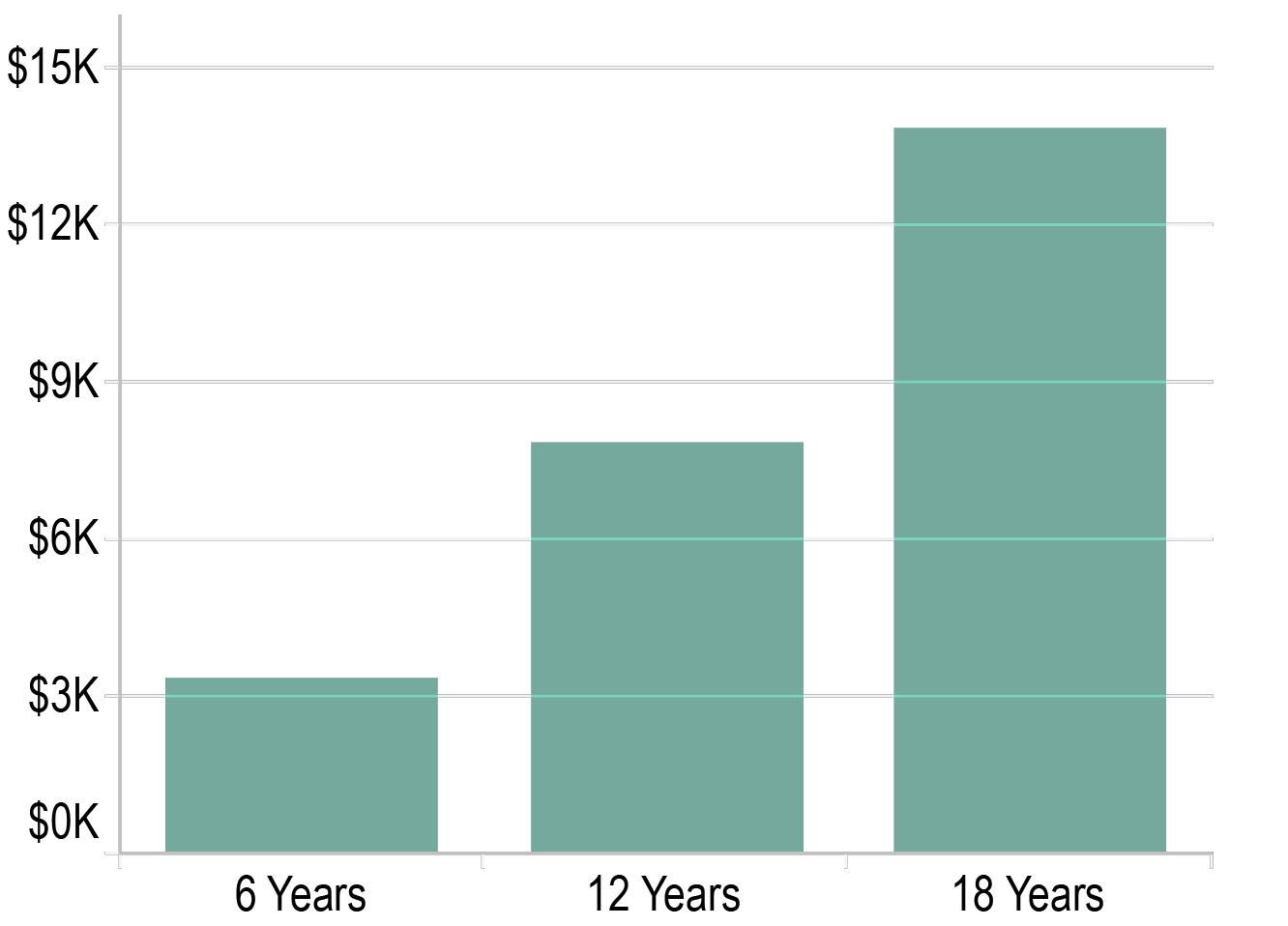

my529 has been helping families save for education for 30 years. Investing now for future educational costs can add up and save you from paying back money you borrowed with interest. my529 also has tax advantages that helps you reach your savings goals.

This hypothetical scenario is for a my529 account over 18 years with a contribution of approximately $40 at account opening and on the first day of each month, with a 5% rate of return compounded annually.

What can my529 savings be used for?

College pays.

So does an early start to savings.

At my529 we believe in your child’s budding talents–his fascination with flight, her knack for math or love of painting. We help you invest for education so you can help your child achieve his or her dreams.