Investment Options

A diverse menu

my529 offers an array of investment options. Each option uses a different investment strategy. Choose the option that works best for you.

Target Enrollment Date

The Target Enrollment Date investment option consists of 12 Enrollment Date portfolios. Each two-year portfolio reallocates to a more conservative investment allocation each quarter. Use the slider below to see how allocations change every two years as your beneficiary ages closer to enrollment. You may select a portfolio closest to the year you anticipate the account beneficiary will begin taking withdrawals for qualified education expenses. If your risk tolerance is more aggressive or conservative, you may select a date further from the expected date of school enrollment (aggressive) or nearer to the expected date of school enrollment (conservative) to meet your needs.

Click on the chart below or drag the slider to explore the Target Enrollment Date portfolios.

Asset Allocations

Net Asset Value

The performance data shown above reflect past performance and are not an indication or guarantee of future results. Investment returns and principal value will fluctuate with market conditions. Investments, when sold, may be worth more or less than the original cost; in short, your investment could lose value. Current performance may be lower or higher than the performance data cited.

Investment returns take into account the underlying investment performance for each period, including applicable interest and dividends, and are net of fees. Individual account performance will vary relative to the stated performance depending on the timing of buy and sell transactions within each account.

For the Target Enrollment Date investment option, the performance reflects changes in asset allocations over time relating to the target year the account beneficiary will begin withdrawing funds to pay for qualified education expenses.

Most recent month-end total returns may be found at https://my529.org/performance-returns/.

Notes

- Year-to-date calculations are based on a calendar year; January 1 to the current month-end date.

- Average annualized returns for investment options with an inception date in the past 12 months are cumulative and non-annualized.

- The inception date is the first date that the investment option was offered and/or received a contribution.

12 Target Enrollment Date portfolios

- Select a portfolio for when the beneficiary begins taking withdrawals.

- Built from mix of:

- Vanguard mutual funds.

- PIMCO Interest Income Fund.

- FDIC-insured accounts.

- Based on preset quarterly investment allocation schedule.

- Portfolios gradually shift to more conservative allocations.

- Eventually end up in Enrolled portfolio.

- Two option changes allowed per year.

- View/download a PDF pie chart of the Target Enrollment Date portfolios.

Static Options

Static investment options remain in the stated allocations for the life of the account. However, you can request an option change and move your invested funds into another option. You can make only two option changes per calendar year. Click on the chart below or drag the slider to compare allocations.

Asset Allocations

Net Asset Value

Performance Summary

| Latest Month | Latest Three months | Year to Date1 | One Year | Average Annualized Return2 | Inception date3 | |||

|---|---|---|---|---|---|---|---|---|

| Three Year | Five Year | Ten Year | Since Inception | |||||

The performance data shown above reflect past performance and are not an indication or guarantee of future results. Investment returns and principal value will fluctuate with market conditions. Investments, when sold, may be worth more or less than the original cost; in short, your investment could lose value. Current performance may be lower or higher than the performance data cited.

Investment returns take into account the underlying investment performance for each period, including applicable interest and dividends, and are net of fees. Individual account performance will vary relative to the stated performance depending on the timing of buy and sell transactions within each account.

For the Target Enrollment Date investment option, the performance reflects changes in asset allocations over time relating to the target year the account beneficiary will begin withdrawing funds to pay for qualified education expenses.

Most recent month-end total returns may be found at https://my529.org/performance-returns/.

Notes

- Year-to-date calculations are based on a calendar year; January 1 to the current month-end date.

- Average annualized returns for investment options with an inception date in the past 12 months are cumulative and non-annualized.

- The inception date is the first date that the investment option was offered and/or received a contribution.

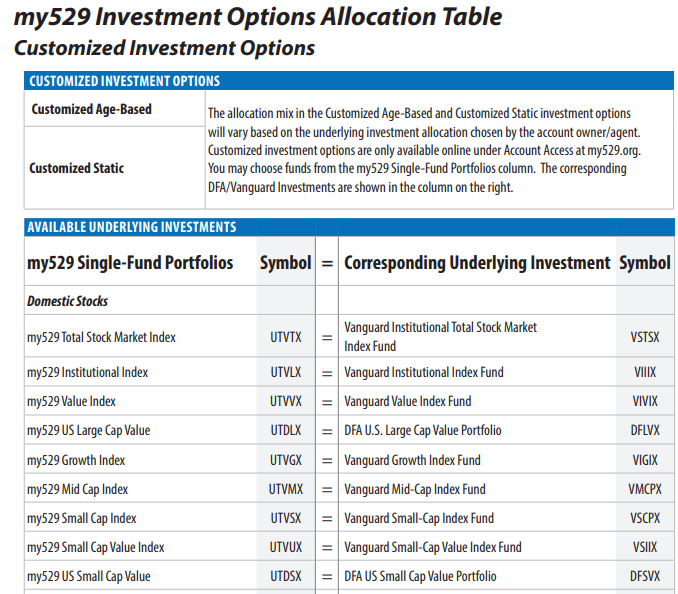

Customized Age-based

The Customized Age-Based investment option allows you to determine and create your own investment allocation using any combination of the available my529 single-fund portfolios for each of 10 age brackets.

You determine and customize the investment allocation for each of 10 age brackets: 0-3, 4-6, 7-9, 10-12, 13-14, 15, 16, 17, 18, 19+. Money in the account will be rebalanced annually on your beneficiary’s birthday to bring the underlying investments back to the target allocation that you chose when you created this option.

Money invested in the Customized Age-Based option automatically reallocates to the new investment allocation that you have chosen when your beneficiary ages to the next bracket.

Consult your financial advisor before investing. If you do not fully understand the decisions you are making by selecting either customized investment option, you should consider whether this option is an appropriate choice.

PLEASE NOTE: Three underlying funds available for a Customized investment option also exist as standalone investments in our Static investment options. The three funds are: my529 Total Stock Market Index (UTVTX); my529 FDIC-Insured Portfolio (UTFIX); or my529 Stable Value (UTPSVX). If you choose one of these funds as the sole allocation for your customized portfolio, you could achieve the same investment strategy at a lower cost by selecting the same fund within the Static investment option.

Customized Static

The Customized Static investment option allows you to determine and create your own investment allocation using any combination of the available underlying funds.

This option will not change as your beneficiary ages, unless you request an investment option change. Money in the account will be rebalanced annually on your beneficiary’s birthday to bring the underlying investments back to the target allocation that you chose when you created this option.

Consult your financial advisor before investing. If you do not fully understand the decisions you are making by selecting either customized investment option, you should consider whether this option is an appropriate choice.

PLEASE NOTE: Three underlying funds available for a Customized investment option also exist as standalone investments in our Static investment options. The three funds are: my529 Total Stock Market Index (UTVTX); my529 FDIC-Insured Portfolio (UTFIX); or my529 Stable Value (UTPSVX). If you choose one of these funds as the sole allocation for your customized portfolio, you could achieve the same investment strategy at a lower cost by selecting the same fund within the Static investment option.

About underlying investments

Depending on which investment option you select for your account, my529 pools your investment in a combination of Vanguard Group and Dimensional Fund Advisors mutual funds, the PIMCO Interest Income Fund, or the FDIC-insured accounts held in trust at Sallie Mae Bank and U.S. Bank. Collectively, these funds and accounts are referred to as underlying investments. Learn more about our underlying investments.

The my529 account owner owns units of the investment option issued by the my529 Trust. The my529 account owner does not own shares of any underlying investment.

Allocation tables for my529 investment options

For a side-by-side comparison of our options, please review the underlying fund allocations for all of my529’s Enrollment Date portfolios and Static investment options. You can also view the funds available for the Customized options.