Withdrawals

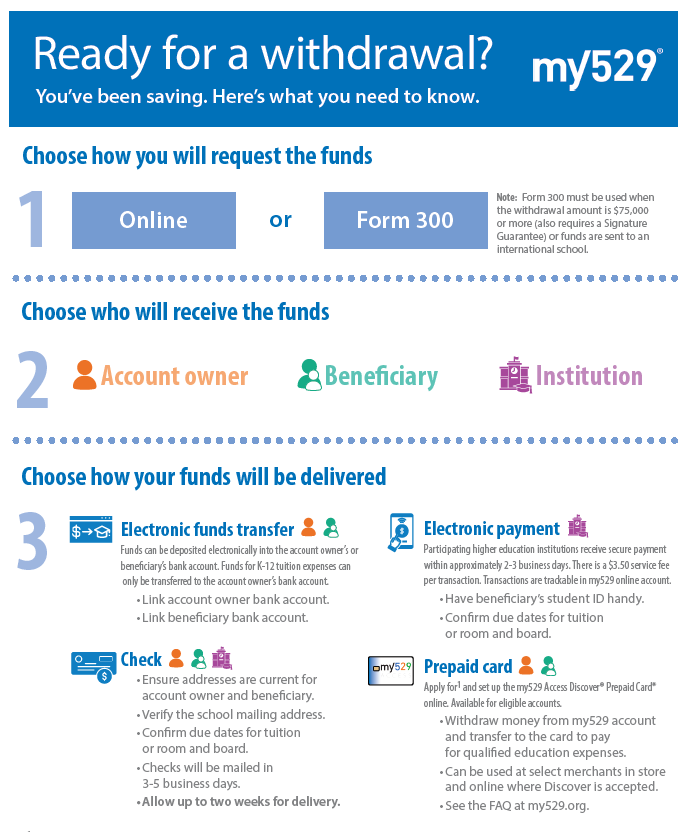

You’ve been saving, and now you’re ready to make a withdrawal

Here’s how

Online

Log in to your my529 account. Click “Withdrawals” and follow the prompts. Funds can be deposited electronically into your or your beneficiary’s bank account.

Secure electronic payment

Send an electronic payment that arrives directly to the school within approximately 2-3 business days. The expedited service costs $3.50 per transaction. Electronic payments can only be completed online. Track the payment status on the Transactions page of your online account. Note: Not every higher education institution participates. K-12 institutions are not included. Click below for more information on secure electronic payments with my529.

my529 Access Discover® Prepaid Card

my529 offers the my529 Access Discover® Prepaid Card. Once you apply* and set up your my529 Access Card online, you will be able withdraw money from your my529 account and transfer it to the my529 Access Card to pay for education expenses. Click below for more information about the my529 Access Card.

*IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW MY529 ACCESS CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents.

The my529 Access Discover® Prepaid Card is issued by Central Bank of Kansas City, Member FDIC. Discover and the Discover acceptance mark are service marks used by Central Bank of Kansas City under license from Discover Financial Services. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and Fee Schedule at my529accesscard.com. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us 24/7/365 toll-free at 1.844.545.0805.

Mail or fax a Withdrawal Request form

Submit a Withdrawal Request form (Form 300). You can instruct my529 to mail a check to you, your beneficiary, the school where your beneficiary is enrolled, to another 529 college savings plan, or to an ABLE account. Withdrawals for student loan repayments and apprenticeships can go to the account owner or beneficiary. Withdrawals to pay for K-12 tuition expenses will be sent only to the account owner.

IRA Roth rollover

Funds from an established 529 account can be transferred tax-free to a Roth IRA for the beneficiary of the 529 account, with certain restrictions. Now, unused educational funds have the potential to kickstart a beneficiary’s Roth IRA savings. Read our FAQ.

Key points about withdrawals

- Some withdrawals may require a signature guarantee. Read the Program Description for more information.

- my529 is required by federal law to issue an IRS Form 1099-Q when funds are withdrawn from an account. Read the Program Description for more information.

Be sure your withdrawals are for qualified expenses.

Tax penalties for nonqualified withdrawals

- The earnings portion of a nonqualified withdrawal is subject to federal income tax and — for Utah residents — Utah state income tax.

- The earnings portion of a nonqualified withdrawal is also subject to an additional 10 percent federal tax penalty, except in limited circumstances — a beneficiary’s death, disability, receipt of a scholarship, or attendance at a U.S. service academy.

- An account owner who is a Utah taxpayer must pay Utah state income tax on the earnings portion of a nonqualified withdrawal in addition to paying federal income tax and penalties. The Utah account owner must also add back the amount of the nonqualified withdrawal as income on their Utah state income tax form for the taxable year the nonqualified withdrawal was made. (If contributions were made for the current or a prior year and the taxpayer did not receive a my529 credit, no addback is required for a nonqualified withdrawal.)

- Consult with your tax advisor about what constitutes a qualified withdrawal.

If your beneficiary decides not to go to college

You can transfer the funds in your account to another beneficiary who is a member of the previous beneficiary’s family.

Read the Program Description for more information.