Roth IRA rollovers

How do I roll funds from a my529 account into a Roth IRA?

First, let’s verify if you have eligible account funds:

- Has your account been open for at least 15 years? Hint: You can see the my529 account creation date on your quarterly statements. See more information in our FAQ “If I change my beneficiary or account owner, does that reset my 15-year clock?”

- The my529 beneficiary and the Roth IRA owner are the same person.

- The rollover doesn’t exceed the Roth IRA owner’s contribution limits such as:

- Not exceeding Roth IRA owner’s earnings for the chosen year.

- Not exceeding applicable Roth IRA contribution limits.

- Not exceeding an aggregate rollover amount of $35,000.

- Not exceeding the total amount contributed to the 529 account (including related earnings) before the five-year period prior to the rollover.

Once you have verified you have eligible funds, fill out Form 310, the Roth IRA Rollover Request Form, and submit it via mail or fax to my529.

Frequently Asked Questions

What is the SECURE Act 2.0?

On December 29, 2022, the SECURE Act 2.0 was signed into law as part of the federal Consolidated Appropriations Act of 2023. The goal of the SECURE Act — an acronym for Setting Every Community Up for Retirement — is to encourage saving toward retirement and to expand employee participation in retirement plans.

How will SECURE Act 2.0 affect 529 plans?

SECURE 2.0 allows funds from an established 529 account to be transferred tax-free to a Roth IRA for the beneficiary of the 529 account. Now, unused educational funds have the potential to kickstart a beneficiary’s Roth IRA savings. This change, however, comes with limitations. Here is what we know so far:

- The 529 account must have been open for at least 15 years.

- The beneficiary of the 529 account and the owner of the Roth IRA must be the same person.

- The amount of the rollover is limited:

- Annual rollovers are subject to applicable Roth IRA contribution limits.

- Rollover amounts from all 529 plan accounts may not exceed $35,000.

- Rollovers may not exceed the amount contributed to the 529 account (and related earnings) before the five-year period prior to the rollover.

Note: According to the IRS, a distribution made after December 31, 2023, and before April 15, 2024, that is rolled over to a Roth IRA by April 15, 2024, and designated for 2023 would be reported as a Roth IRA contribution for 2023. Indicate to your Roth IRA trustee which year they should record your IRA contribution. Please consult a tax advisor for more information specific to your situation.

Still have questions? We do, too! The 529 industry submitted a letter to the IRS in September 2023 seeking answers on this matter. It is unclear when the IRS will provide the requested guidance, which could affect the tax treatment of your 529-to-Roth IRA rollover.

I have verified my account is eligible for a rollover. How do I initiate the process?

To rollover funds from a my529 to a Roth IRA, please complete Form 310, Roth IRA Rollover Request.

How can I find my account creation date?

Account owners can contact my529 to find the account creation date. my529 has also added the account creation date to the quarterly account statements as of Q4 2023.

If the account was rolled over to my529 from another 529 plan, the Call Center can provide the date the account was opened at my529, but the account owner must consult their own records or contact the original 529 plan for the initial account creation date.

Advisors can download the current date summary report from my529 to see the account agreement date for the my529 account. For advisor accounts that were rolled into my529, the advisors may need to refer to their own records or contact the 529 plans where the accounts were initially opened.

Are indirect rollovers allowed? Can an account owner take a withdrawal for themselves and then send the money to a Roth IRA account?

No. A Roth rollover from my529 must be paid in a trustee-to-trustee transfer.

Account owners must establish a Roth IRA account before requesting a rollover. If the Roth IRA trustee requires a Letter of Acceptance, the account owner will need to direct them to send that letter to my529 before my529 can rollover the funds. Funds can only be sent to the trustee.

Section 529 requires that the 529 account be open for at least 15 years before a qualified rollover may be made to a Roth IRA. If a my529 account was opened with a rollover from another plan, does that reset my 15-year clock?

my529 does not have any guidance from the IRS on whether a rollover from another 529 plan resets the 15-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide the requested guidance.

If I change my beneficiary or account owner, does that reset my 15-year clock?

my529 does not have any guidance from the IRS on whether a change of beneficiary or account owner resets the 15-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide the requested guidance.

How do I know which funds have been invested for at least 5 years and are eligible to rollover?

my529 does not have any guidance from the IRS on this five-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide the requested guidance.

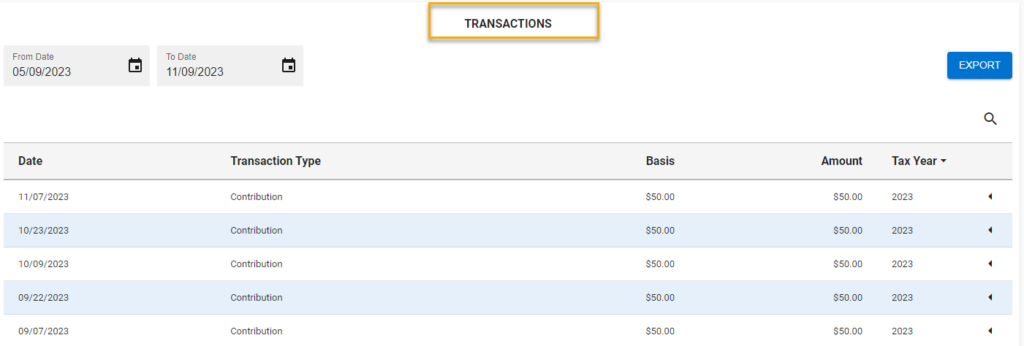

Account owners can review transactions and sort by year online through their my529 account access. The transaction items can be exported and sorted by year to research contributions further.

Can I initiate a rollover from another 529 plan and a rollover to a Roth IRA? Does the 12-month rule apply to both?

The 12-month rule only applies to rollovers from a 529 program to another 529 program.

If I’ve rolled over from another 529 plan to my529 within the last 12 months, do I have to wait until the 12-month rollover period is expired before I can rollover to a Roth IRA?

The 12-month rule only applies to rollovers from a 529 program to another 529 program.

How do internal transfers impact rollover eligibility?

my529 does not have any guidance from the IRS on how internal transfers impact the ability to rollover to a Roth IRA. It is unclear if or when the IRS will provide the requested guidance.

To the extent that this references a beneficiary change, please see question ”If I change my beneficiary, does that reset my 15-year clock?” above.

Do I use the withdrawal Form 300 to rollover funds to my Roth IRA?

No, please submit Form 310, Roth IRA Rollover Request.

Can I make the request online through my account portal?

No, please submit Form 310, Roth IRA Rollover Request. All Roth IRA rollover requests are processed using Form 310.

Does my beneficiary have to be over the age of 15 to qualify for a rollover to a Roth IRA?

There is no age requirement of the beneficiary, but it is required that the beneficiary of the 529 account be the same as the owner of the Roth IRA account. Please note that the Roth IRA account owner should have income equal to the contribution in the tax year of the rollover. Please see my529 Form 310, Roth IRA Rollover Request, for applicable requirements to complete a rollover to a Roth IRA.

If my account has closed, and I request to reopen my account, does that reset my 15-year clock?

The IRS has not provided guidance on how it would handle this situation. If the IRS were to treat such an account reopening as not resetting the 15-year clock, any new contributions would have to be in the account for at least 5 years. See “How do I know which funds have been invested for at least 5 years and are eligible to rollover?” above.

What happens if the Roth IRA trustee rejects my rollover?

Please be aware that your Roth IRA trustee may have its own rules and regulations with regard to a rollover from a 529 account to a Roth IRA account. If your rollover does not meet the Roth IRA trustee’s rules and regulations, the rollover could be rejected. You should confirm with your Roth IRA trustee that your rollover will meet its rules and regulations prior to requesting a rollover. You may also wish to verify with your Roth IRA trustee how the rollover will be handled. Rollover requests that are rejected by the Roth IRA trustee and returned to my529 will be treated as new contributions by my529.