For Employers

A voluntary financial wellness benefit for your employees

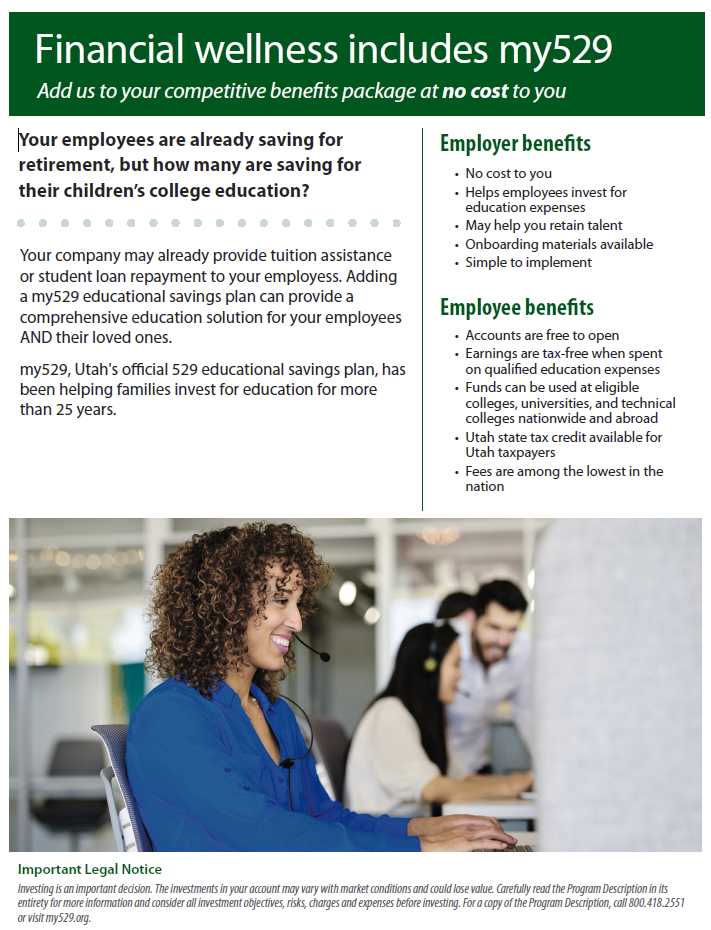

my529 is an investment in the future and a benefit to your employees — all at no cost to you.

Offering employees my529 as a means to invest for education shows you care about them, their families and their own educational pursuits.

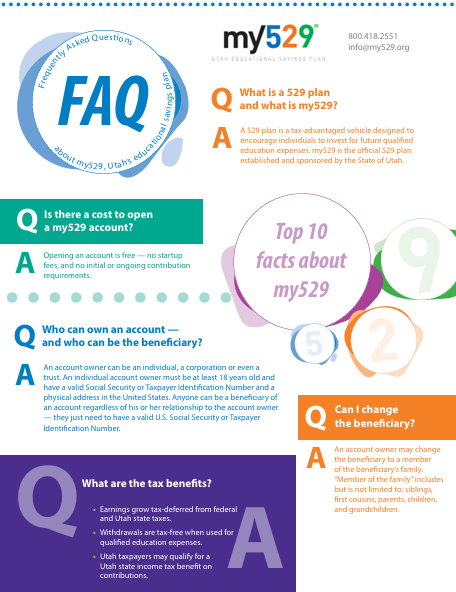

FAQ

Read our FAQ to learn more about how a my529 account works — from account owners and beneficiaries to contributions, tax advantages, and how funds can be used.

For more information, contact employer@my529.org.

Some credentialing programs, certifications and continuing education now qualify for my529 funds

Why offer my529?

Are you looking for a competitive edge to attract and retain high-quality talent?

- According to a Bank of America survey, 62% of employers feel a high degree of responsibility for their employees’ financial wellness.

- Plus, the number of employees who see their financial wellness as at least “good” has decreased over recent years.

Spend a couple of minutes

learning about my529

Utah’s official 529 college savings plan has been helping people prepare for the cost of education for 30 years.

Make a request today

Offer your employees a no cost financial wellness benefit with my529, Utah’s educational saving plan.

Click the button below to request the following:

- my529 presence at a health or benefit fair.

- Presentation (virtual or in-person).

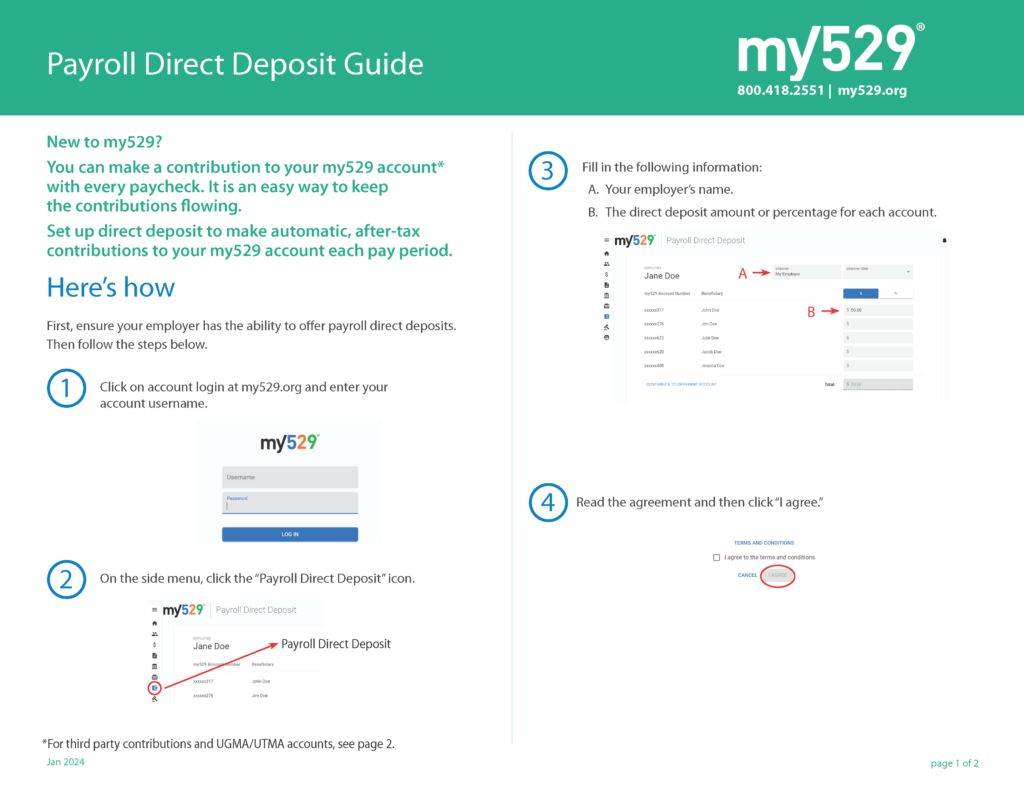

- Interest in payroll direct deposit info.

- Request a promotional offer one sheet for your employees.

Employer benefits

- Helps employees invest for qualified education expenses.

- Can help you retain talent.

- Employee onboarding materials available.

- Simple to implement.

- Increased productivity and morale.

- Loyalty from employees.

Employee benefits

- Accounts are free to open.

- Earnings are tax-free when spent on qualified education expenses.

- Funds can be used at eligible colleges, universities, and technical schools nationwide and abroad.

- Utah state tax credit available for Utah taxpayers.

- Fees are among the lowest in the nation.

- Earnings on nonqualified withdrawals may be subject to federal income tax and a 10% federal penalty, as well as state and local income taxes.

Want to contribute to your employees’ education savings?

Whether you’d like to match your employees’ contributions to their my529 accounts or give something meaningful for a special occasion like an important milestone or birth of a new baby, the my529 Gift Program is here to help.

Downloadable Resources

my529 can provide materials for employee onboarding.

Employer topics

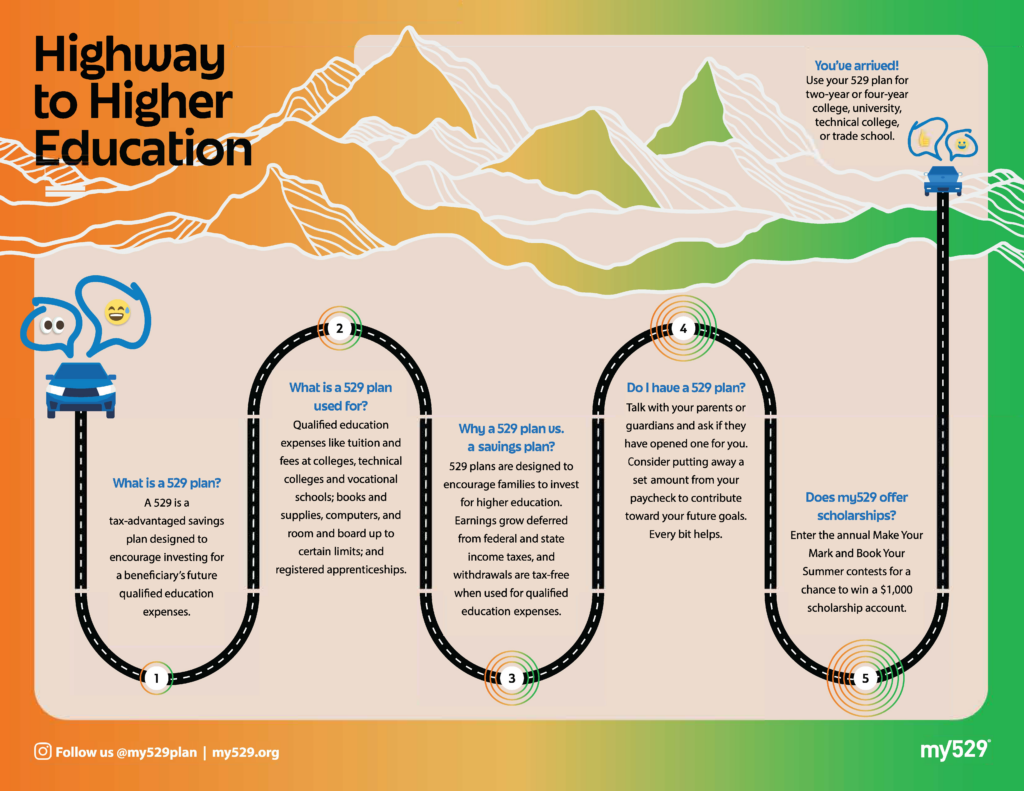

You may use the following articles to help your employees learn more about 529 college savings plans. Share links through your workplace newsletters, emails or intranet.

-

Did you know that my529 helps to run charitable Children Savings Account programs?

my529 has created over 12,000 CSA accounts with nonprofit, government and education organizations headquartered in more than 15 states. These

-

The new my529 incentiFive Program can help kickstart your newborn’s education savings

incentiFive is designed to help Utah families get an early start on an education savings habit. Here’s how it works:

-

New ways to use your my529 funds for K-12 expenses

Parents, rejoice: You now have the flexibility to use my529 funds for your student’s education costs beyond just tuition at