my529 Advisor Library

Estate planning with my529

Did you know that a my529 account can help with estate planning?

529 accounts have unique features that you can use as you advise your clients on saving for college, investing and estate planning.

my529’s library of FAN articles and blog posts

-

my529 earns top industry rating for 15th consecutive year

This fall, my529, Utah’s 529 educational savings plan, was once again named as one of the top 529 plans in

-

Qualified education expenses expand with recent legislation

Recent legislation offers your clients more possibilities for their 529 funds. H.R. 1 was passed by the 119th Congress and

-

my529 expands Docusign acceptance policy

You gave us your feedback, and we heard you! my529 now accepts Docusign signatures that have been phone authenticated (via

-

Using my529’s College Savings Estimator to encourage saving early and often

Go beyond the basics of how the College Savings Estimator can help anticipate school costs. Today, let’s explore how this

-

Meet the team!

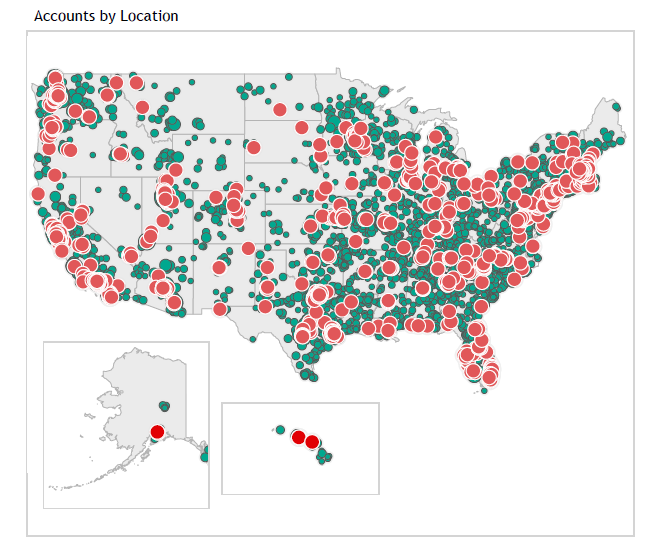

We’ve been busy this fall! The my529 team traveled around the nation to spread knowledge of the importance of 529

-

Follow us on LinkedIn!

Do you follow us @my529 on LinkedIn? Our weekly content is designed to be shared with YOUR clients — help

-

Admin fee drops for my529’s Customized options

my529 recently reduced the Administrative Asset Fee for Customized Age-Based and Customized Static investment options by one basis point (0.010%).

-

my529 changes name of single-fund portfolio available in Customized options

As part of my529’s fiduciary responsibility to our account owners, we closely monitor plan offerings. After a long evaluation of

-

Here’s how to help your clients prepare for fall withdrawals

As families send their kids back to school, there are many ways to help your clients transition their students back

-

Use our College Savings Estimator to prepare your clients for higher education expenses

It would be nice to predict the future for your clients. While we can’t offer you that, we can give

-

Meet the newest member of our team

my529 is delighted to introduce Emilee Hansen, relationship manager, to our Advisor Relationship Management Team. Emilee is a University of

-

You can access your clients’ my529 tax documents

Tax deadlines are approaching and my529 is here to lend a hand. my529 makes it easy for you and your

-

Bulk statement feature expanded for additional users at the firm

We heard you asking for this option and are delighted to announce that we made it happen! We are excited

-

Divorce: How advisors can help their clients navigate this transition

Navigating clients through a divorce can be complicated and challenging for financial advisors. You may have clients with my529 accounts

-

Updates coming to Target Enrollment Date option in July

On July 1, 2025, my529’s Target Enrollment Date investment option will see portfolio changes as part of its regularly scheduled

-

On the road spreading the message of college savings

Our Relationship Management Team hit the road this spring to talk 529s. So far, we have been to Wallach Beth

-

Have you checked out the my529 video library?

Our my529 video library provides you with a comprehensive and easily shareable resource to educate your clients about the benefits

-

The value of higher education

When speaking with your clients about 529 plans, you might have heard mixed reviews from them and their children about

-

my529 earns top Morningstar honor for 14th year in a row

This fall, Morningstar’s annual review of 529 plans named my529 as one of five plans in 2024 to receive the

-

2024 year-end deadlines

Your clients could qualify for certain tax benefits with their my529 account. Please note that contributions must be received at

-

What drives the next generation of financial planners?

We recently had the pleasure of interviewing Lexi Shipley, president of the Personal Financial Planning Student Association (PFPSA) at Utah

-

Study up on changes to federal student aid application

Did you know that the FAFSA (Free Application for Federal Student Aid) for the 2025-2026 academic year officially went live

-

my529 Road Trip: Financial fun across the nation

Our financial advisor team has been hitting the road and spreading the joy of smart saving across the country and

-

my529’s Investment Manager Series: PIMCO Interest Income Fund and FDIC-Insured

my529 offers multiple principal preservation products, including the PIMCO (Pacific Investment Management Company) Interest Income Fund and our FDIC-Insured accounts.

-

my529’s Investment Manager Series: Vanguard

In 1999, my529 (known as Utah’s Educational Saving Plan at the time) looked to expand their investment options, allowing account

-

Help your clients with Gen Z dependents explore various higher education paths

High school graduates have more education options than ever, and with that increased variety, your savvy clients want to be

-

Changes for three Vanguard funds affect underlying fund expenses

Changes to three Vanguard funds used in my529 investment options in April and May could impact underlying fund expenses for

-

Administrative Asset Fee reduced by 1 bps for all investment options

On August 1, 2024, my529 dropped the Administrative Asset Fee by one basis point for every my529 investment option, including

-

Keeping your information up to date with my529

Is your firm’s information up to date with my529? Updating your contact information is easy and important to do. As

-

Make sure your clients have a signature card on file so they can access their funds

Want to streamline your client’s my529 experience? Have them add a signature card to their my529 account. Providing a signature

-

We want to hear from you!

The my529 Financial Advisor portal now has an orange feedback button listed on the right side of the screen where

-

my529 loves to present

Did you know that my529 has a Professional Services Team exclusively available to our financial advisors? This group of my529

-

Call for advisor interviews

Do you work with a niche clientele or have a special interest in the field? We would like to interview

-

my529’s investment manager series: Dimensional Fund Advisors

my529 has been offering select funds from Dimensional Fund Advisors (DFA) since 2013. my529 offers eight underlying DFA funds in

-

my529 to Roth IRA transfers with SECURE 2.0

SECURE 2.0 offers an exciting new opportunity—allowing my529 account owners to transfer funds to a Roth IRA. While still new,

-

How does your firm stack up?

Over the years, we have enjoyed many conversations with our advisors. We thought it might be worthwhile to share how

-

Financial planning for children with special needs

my529 met Neil Mahoney at a recent event where he presented on the topic of financial considerations for families with

-

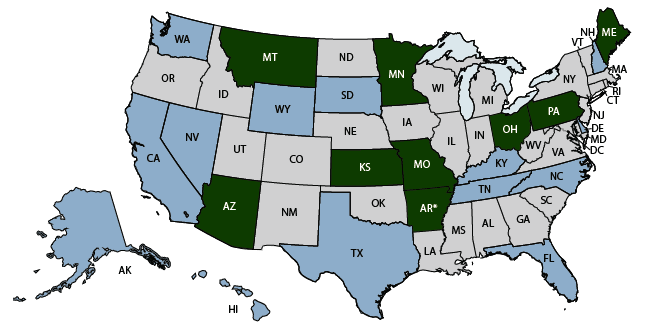

The state of 529 tax advantages

Are incentives available where you live? As tax season approaches, it is important to inform your clients about state income

-

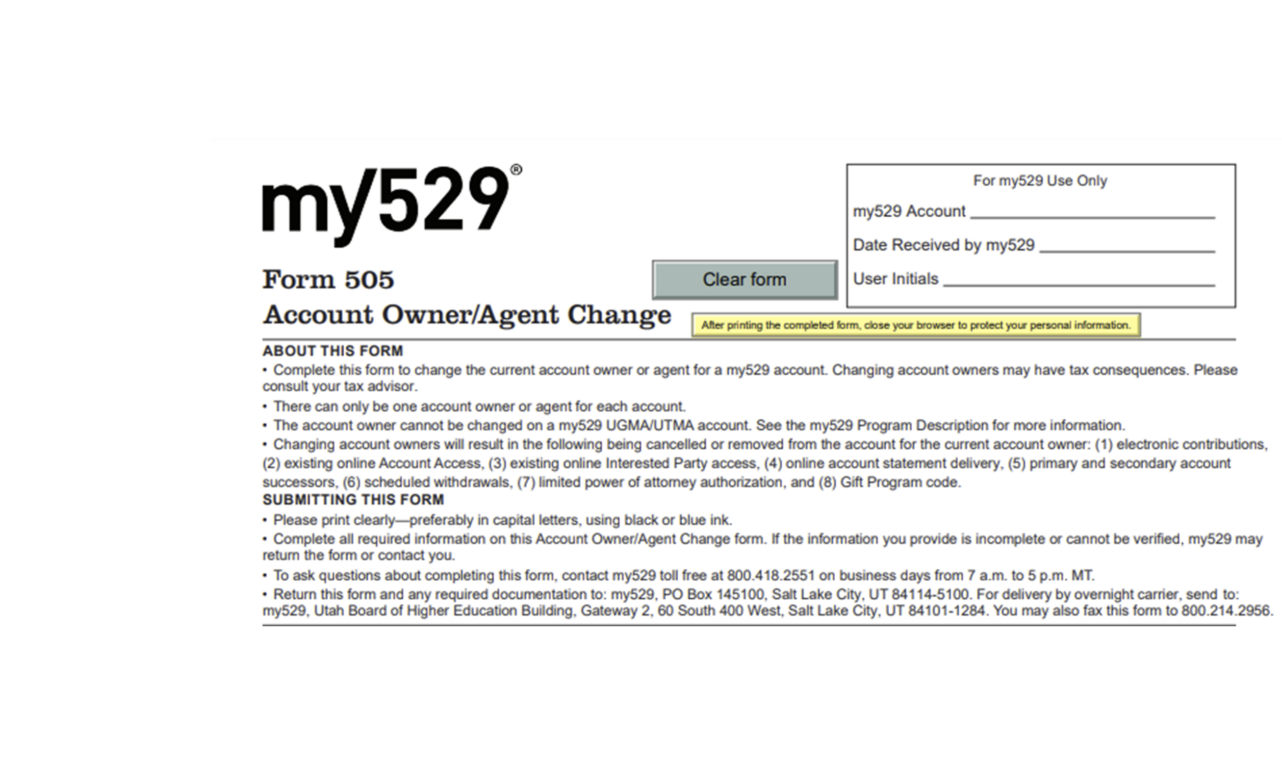

What to do if a my529 account owner dies

Helping your clients manage the financial aspects of a loved one’s passing can be a difficult task. If the deceased

-

Utah is changing—is your firm staying current?

As Utahns, we know the state is changing quickly. But we also know that your clients have many of the