You can access your clients’ my529 tax documents

Tax deadlines are approaching and my529 is here to lend a hand.

my529 makes it easy for you and your clients to access the documents they need to fill out their 1040s.

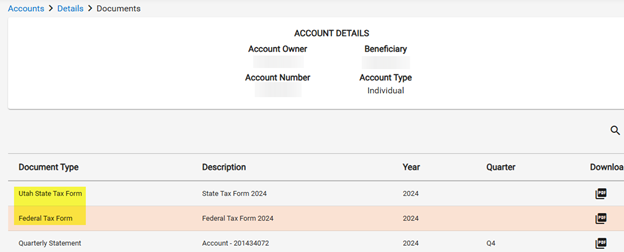

If your client made a withdrawal in 2024, their IRS Form 1099-Q is available in their online my529 account under the Documents tab.

Utah residents who made a contribution, withdrawal or transfer in 2024 will also receive a Utah state income tax form TC-675H, which is available in their online my529 account.

The documents are also available through your advisor portal. Read below for how to access your client’s tax documents.

The April 15 federal tax filing deadline also represents the deadline for contributions to a Roth IRA that will count for the 2024 tax year. Federal law allows the transfer of 529 funds to a Roth IRA account, with certain limitations. See our FAQ.

The deadline for contributions to a 529 plan that count for the 2024 tax year ended on December 31, 2024.

To access your client’s tax documents:

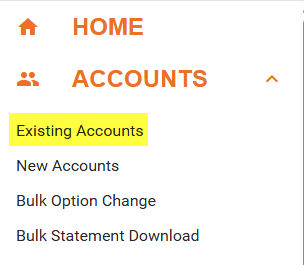

1. Once logged into the advisor portal, click on Existing Accounts from the drop-down menu.

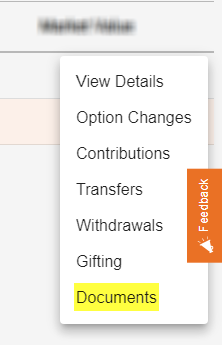

2. Click on the three dots next to your client’s name and select Documents.

3. Tax documents are located in the Documents section.

From the FAN — Spring 2025

| Who gets the 1099-Q? | |

|---|---|

| If funds were sent to the account owner | The account owner |

| If funds were sent to the beneficiary or the school | The beneficiary |