my529 Prepaid Access Card FAQ

Sign up for the my529 Access Discover® Prepaid Card in your online account.

FAQs

What is my529 Access Discover® Prepaid Card?

The my529 Access Card is a convenient way for account owners and beneficiaries to use money withdrawn from their my529 account to pay for qualified education expenses. my529 Access Card is a prepaid card issued by Central Bank of Kansas City.

Why use my529 Access Card?

The my529 Access Card creates convenience and control for the account owner. Each transaction where the my529 Access Card is used will appear on the Card Services monthly statement, making the my529 Access Card a central place to track qualified education expenses. The my529 Access Card is designed to limit merchants who offer products and services such as alcohol, gambling, or adult entertainment to protect against nonqualified purchases.

What can my529 Access Card be used for?

The card can be used to pay qualified education expenses, which include, but are not limited to, the following:

- Mandatory fees, books, supplies and equipment required for the beneficiary to enroll and attend an eligible higher educational institution.

- Computers, peripheral equipment, software and internet access while enrolled in an eligible higher educational institution.

- Expenses for services for a special needs beneficiary to enroll and attend an eligible educational institution.

How does the card work?

my529 Access Card can be used at select merchants for in-store and online purchases where Discover is accepted.

my529 Access Card is funded from the my529 account directly. Once approved and set up, the account owner can add money to the my529 Access Card to pay for qualified education expenses. The account owner has sole control of these accounts and is the only person able to request a withdrawal from their my529 account.

Account owners have the ability to withdraw funds from their my529 accounts and add those funds to their my529 Access Card. Once funds are transferred to the card, they are considered withdrawn from my529 and are no longer invested in the account owners’ my529 accounts. Per IRS rules, funds must be spent within the same period as the expense was incurred to be considered a qualified withdrawal.

Can I use my529 Access Card to pay tuition?

Yes. However, please be aware that your college will likely charge a fee that is a percentage of the transaction amount for using the card to pay tuition. Contact Card Services to explore other options—such as bill pay or e-check via ACH direct debit—to pay tuition using your my529 Access Card. You can reach Card Services at 1.844.545.0805.

How do I transfer money from my my529 account to my529 Access Card?

Once you’re approved, your my529 Access Card will be one of the available online withdrawal options you can choose from in your my529 account.

What if I transfer more money than I need to my my529 Access Card? Can I have it reinvested in my my529 account?

No. Once funds are transferred to the my529 Card, they cannot be reversed or transferred back to my529.

Who can apply for a my529 Access Card?

Applicants must have an individual or institutional my529 account with a beneficiary who is 17 years or older, a physical domestic (U.S.) address, and be an account owner for a minimum of 60 days. Applicants must also register with an email address that is not already in use within the Card Services system.

Once I have been approved, how do I activate my my529 Access Card?

Once an account owner has applied and been approved for the my529 Access Card, they will receive a virtual card. However, it may take up to two days before the card is linked to their my529 account and ready for use. The card requires no activation. Account owners are able to withdraw and transfer funds to their card as soon as it is linked to their my529 account.

If a secondary card is requested for a beneficiary, the beneficiary will automatically receive both a virtual and a physical card. An account owner has the option to request a physical card. Physical my529 Access Cards will require activation by calling Card Services at 1.844.545.0805, or by logging in to Card Services at http://my529accesscard.com.

What if I have my529 accounts for other beneficiaries?

A person who owns my529 accounts for multiple beneficiaries only needs a single my529 Access Card account. The account owner would receive a primary my529 Access Card and has the option to request a secondary card for each my529 beneficiary. Account owners may have one card with a maximum of 10 beneficiaries.

All withdrawals from the owner’s my529 accounts will go to the primary my529 Access Card. Funds could then be transferred to the secondary card accounts by logging in to Card Services. Each card will have the cardholder’s (either account owner or beneficiary) name on it. Only the my529 account owner can fund the beneficiary cards. Beneficiaries cannot move funds between cards.

What is the status of funds moved to my my529 Access Card?

When funds are transferred from the my529 account to your my529 Access Card, it is the same as making a withdrawal from your my529 account. Money that is transferred to your my529 Access Card is no longer invested and is considered withdrawn from my529.

Does the beneficiary build credit by having a my529 Access Card?

No, the my529 Access Card is a prepaid card and does not build credit for the beneficiary or the account holder.

Are there any fees beyond the established my529 program fees for this card?

Card Services charges a $1 Monthly Maintenance Fee.

There is no inactivity fee.

A $1 PIN Purchase Fee also applies. The PIN Purchase Fee of $1 occurs when the card is used to make a purchase and the PIN is entered. Consult the Fee Schedule for more information and complete details.

Are there any merchant restrictions?

my529 Access Card restricts usage at certain businesses, such as those that offer alcohol, gambling or adult entertainment.

What if my card is lost or stolen?

Always keep your PIN in a safe place and never write it on the card. If your card or PIN is lost or stolen, contact Card Services immediately at 1.844.545.0805. Your card is protected by Discover’s Zero Liability Policy. Conditions and exceptions apply, see the Cardholder Agreement for complete details.

What if my my529 Access Card account is closed?

If a my529 Access Card account is closed for any reason, you will be notified and any debit card withdrawal schedules from the my529 account will be canceled. This includes both one-time and recurring withdrawals.

If my my529 account is closed, what happens to funds remaining on the card?

All funds added to a my529 Access Card are available for use to pay for qualified education expenses until they have been exhausted. Per IRS rules, funds must be spent within the same period as the expense was incurred to be considered a qualified withdrawal.

You may also request the unused funds to be returned to you via a check to the mailing address listed on your my529 Access Card account. A fee may apply for check refunds. Please consult the Fee Schedule for more information. The issuer reserves the right to refuse to return any unused balance amount less than $1.

Are there limits for how much can be transferred to a my529 Access Card?

Yes, the my529 Access Card has a maximum balance limit of $75,000.

Are there transaction limits for the my529 Access Card?

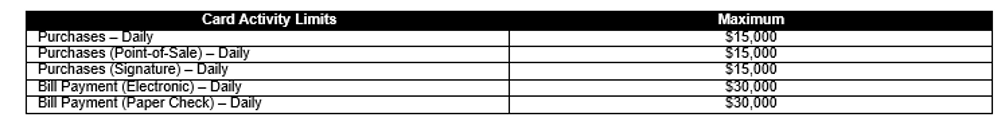

Yes. The following chart outlines the daily transaction limits for the my529 Access Card.

Does my529 Access Card come with overdraft protection?

No, the card does not include overdraft protection.

Will my funds be ready to use immediately?

No. It takes 1-3 business days for funds to be available after a withdrawal request is submitted online at my529.org.

Can I set up recurring withdrawals from my my529 account to my Access Card? How does that work?

Yes, you may set up recurring monthly withdrawals. This option will be available during the online withdrawal process from your my529 account.

Can a my529 Access Card be used to withdraw funds from an ATM?

No. The card cannot be used for ATM withdrawals.

Where do I find my my529 Access Card statement?

Log in to Card Services at my529accesscard.com to view or download your monthly statements.

Can I use my529 Access Card to pay for nonqualified expenses?

Yes, but if you take a withdrawal to pay for nonqualified expenses with a my529 Access Card, you will be subject to taxes and penalties as outlined by the Internal Revenue Service regarding the use of 529 plan funds.

Whom should I notify if I need to update my mailing address?

It is important to remember that you need to update two different accounts: my529 and my529 Access Card.

- Contact my529 at 1.800.418.2551 or log in to your account at my529.org.

- Log in to your my529 Access Card account through Card Services at my529accesscard.com or call 1.844.545.0805.

Please note: updating your information in one location doesn’t automatically update your information in the other.

Who receives the 1099-Q form?

Transferring money to a my529 Access Card is a withdrawal from your my529 account. The account owner will receive a 1099-Q form for all withdrawals from a my529 account within a tax year.

Whom do I call if I have a question about my529 Access Card?

Contact Card Services at 1.844.545.0805 with all questions regarding the my529 Access Card.

I see this is a Discover Card. Where can I use it?

The my529 Access Card is accepted at select merchants where Discover is accepted.

Am I able to log in to my account at Discover.com to check my my529 Access Card balance?

No. Log in to Card Services at my529accesscard.com or call 1.844.545.0805 to check your my529 Access Card balance.

Will Card Services be able to view my my529 account balance?

No. Card Services will not have any information regarding the account owner’s my529 account balances or transactions.

Is there a Discover rewards program associated with the my529 Access Card?

No. There are no Discover rewards programs associated with the my529 Access Card.

The my529 Access Discover® Prepaid Card is issued by Central Bank of Kansas City,

Member FDIC. Discover and the Discover acceptance mark are service marks used by Central Bank of Kansas City under license from Discover Financial Services. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and Fee Schedule at my529accesscard.com. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us 24/7/365 toll-free at 1.844.545.0805.