For Employers

A voluntary financial wellness benefit for your employees

Are you looking for a competitive edge to attract and retain high-quality talent?

- According to a Bank of America survey, 62% of employers feel a high degree of responsibility for their employees’ financial wellness.

- Plus, the number of employees who see their financial wellness as at least “good” has decreased sharply over the past two years.

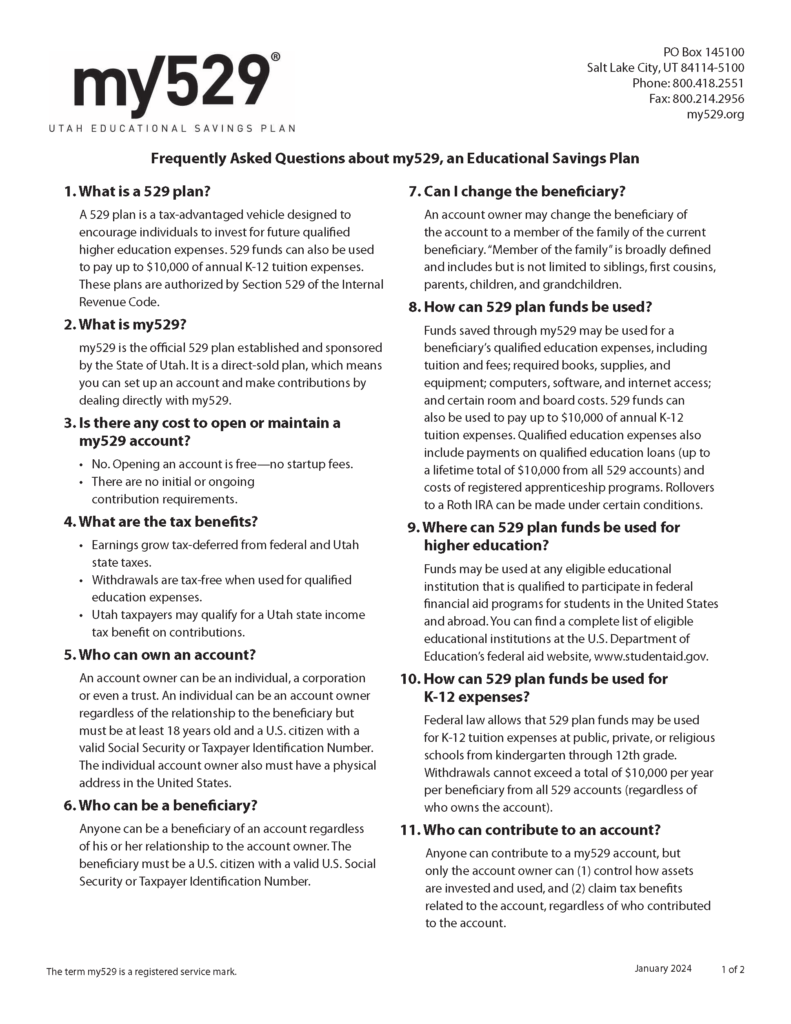

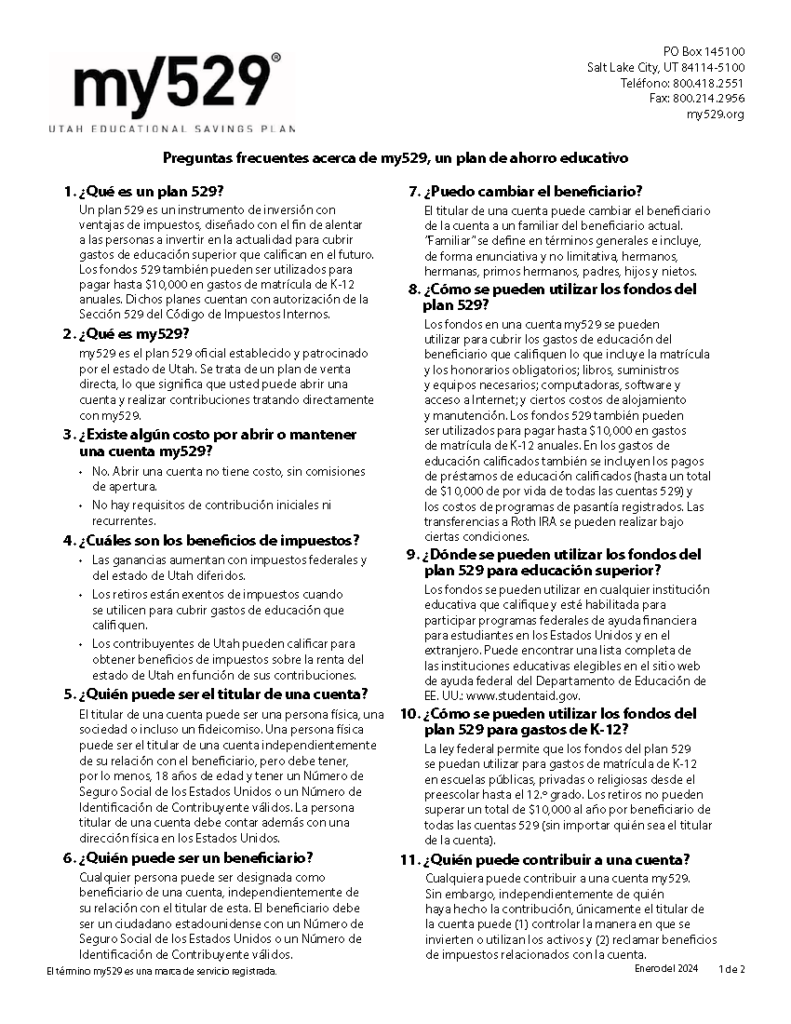

FAQ

Learn more about how a my529 account works—from account owners and beneficiaries to contributions, tax advantages, and how funds can be used.

For more information, contact employer@my529.org

Why offer my529?

my529 is an investment in the future—and a benefit to your employees—all at no cost to you.

Offering employees my529 as a means to invest for education shows you care about them, their families and their own educational pursuits.

Spend a couple of minutes learning about my529

Utah’s official 529 college savings plan has been helping people prepare for the cost of education for more than 25 years.

Make a request today

Offer your employees a no cost financial wellness benefit with my529, Utah’s educational saving plan.

Click the button below to request the following:

- my529 presence at a health or benefit fair.

- Presentation (virtual or in-person).

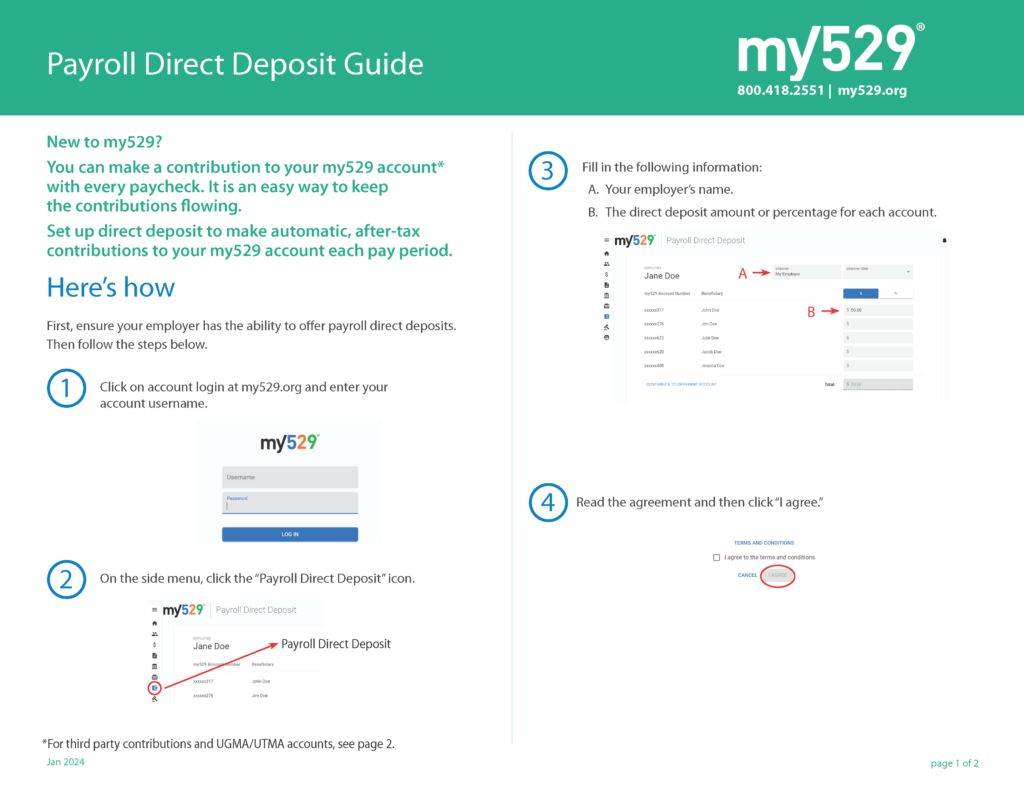

- Interest in payroll direct deposit info.

- Request a promotional offer one sheet for your employees.

Employer benefits

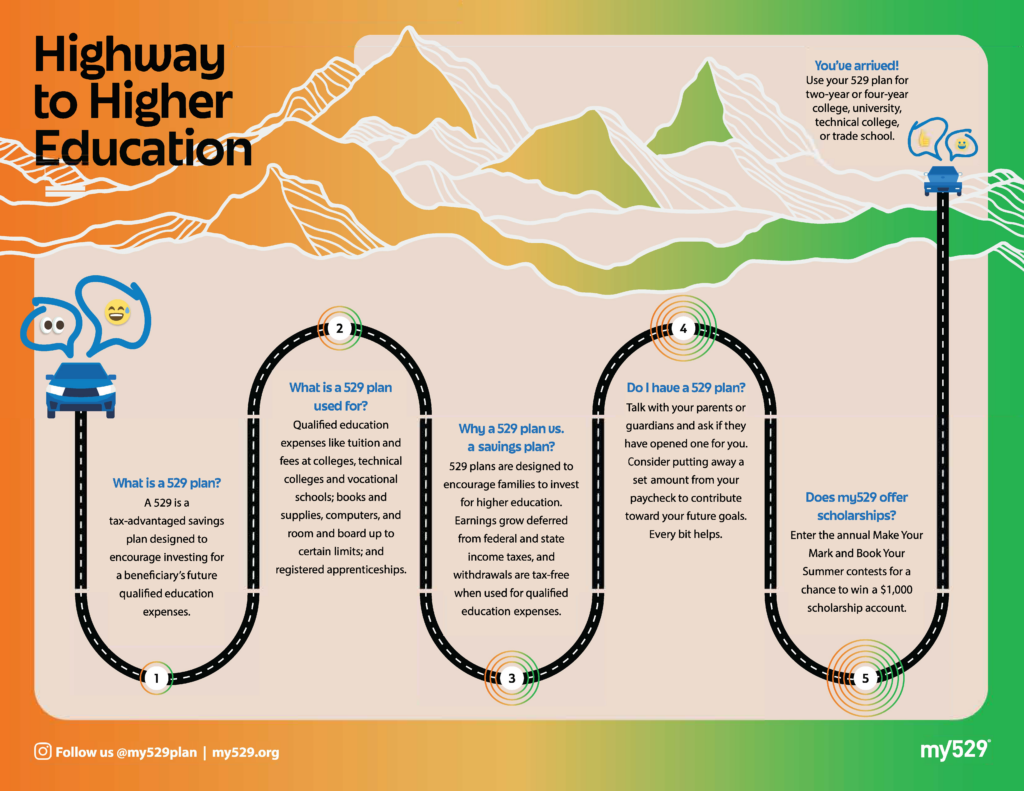

- Helps employees invest for qualified education expenses.

- Can help you retain talent.

- Employee onboarding materials available.

- Simple to implement.

- Increased productivity and morale.

- Loyalty from employees.

Employee benefits

- Accounts are free to open.

- Earnings are tax-free when spent on qualified education expenses.

- Funds can be used at eligible colleges, universities, and technical schools nationwide and abroad.

- Utah state tax credit available for Utah taxpayers.

- Fees are among the lowest in the nation.

- Earnings on nonqualified withdrawals may be subject to federal income tax and a 10% federal penalty, as well as state and local income taxes.

Downloadable Resources

my529 can provide materials for employee onboarding.

Employer topics

You may use the following articles to help your employees learn more about 529 college savings plans. Share links through your workplace newsletters, emails or intranet.

-

Aunts and uncles: Get invested in the success of your nieces and nephews

July 26 is Aunt and Uncle Day! These loved ones play a unique role in a child’s life, offering support, […]

-

Summer saving strategies for your my529 account

Summer is almost here, and with the change of season comes new opportunities to help you hit your savings goals. […]

-

How can ‘extra’ 529 funds be used?

Money in 529 accounts can be used for any qualified education expense, such as tuition, room and board (as long […]