Using my529’s College Savings Estimator to encourage saving early and often

Go beyond the basics of how the College Savings Estimator can help anticipate school costs.

Today, let’s explore how this powerful tool can assist you in tailoring answers to your clients’ unique higher education questions as well as helping them prioritize saving for higher education among their other long-term financial goals.

The estimator calculates costs and progress toward savings goals based on information you enter (school location, beneficiary’s grade, current savings, and monthly contribution). You can explore multiple possibilities by adjusting the options (a specific school or average cost, public or private, in-state or out-of-state, two-year versus university). A favorite feature of the estimator allows you to create and save different scenarios, enabling your clients to compare variables and helping you to provide valuable insights and guidance.

The College Savings Estimator — which you can now access through the resource tab from the dropdown menu in the advisory portal — and other tools provided on my529.org can help you find answers (and visuals!) to your clients’ most common higher education questions.

What are considered standard benchmarks for when and how much to save for higher education?

On our website you can find the College Savings Plans Network’s Roadmap For Their Future, which helps clients see the benefits of saving across their child’s life and prepares them to better navigate anticipated obstacles or unexpected rough patches. It offers guidance at every age to prepare for higher education and even provides a tracker to demonstrate how setting aside just $10 a week can add up quickly over the years, which you can then visualize through a customized plan within the College Savings Estimator tool. Complementing the road map with Estimator scenarios tailored to clients’ savings goals will help them see how education savings fits into their overall portfolio for the future.

How much money should they save from each paycheck?

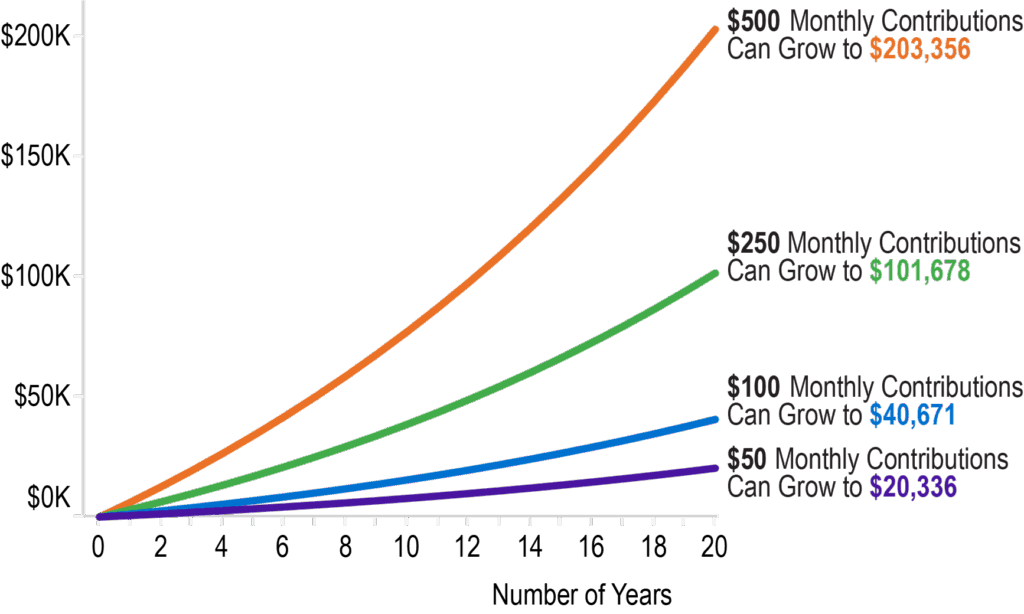

You know well that every dollar saved means money your clients won’t have to borrow and pay interest on — and the earlier they begin saving, the more potential their my529 account has to grow. Saving even small amounts early and often can add up quickly over time, so use my529’s College Savings Estimator to help your clients decide their savings goals and develop their own custom roadmap.

What if their student chooses not to attend a traditional college program?

The funds in their my529 account can be used at many types of eligible educational institutions, including technical colleges. my529 funds may also be used for registered apprenticeship programs and now qualified postsecondary credentials. The College Savings Estimator can also help compare the costs of two-year college versus four-year programs.

What happens if their student earns a scholarship?

Even if tuition is paid, other costs may not be covered by a scholarship. my529 accounts can be used for any qualified education expenses, including room and board, books, computers, software and more. The College Savings Estimator allows you to factor these additional costs into clients’ higher education estimates and can even project personal expenses, which are not covered by 529s, but are also important to consider when budgeting.

What common questions did we miss? Please reach out to our Advisor Relationship Management team with your thoughts so we can better help you prepare your clients for their education savings.

From the FAN — December 2025

Investing small sums regularly over time

can help make higher education more affordable

(This scenario is for a my529 account with a beginning balance of zero dollars and the amount stated contributed on the first day of each month over 18 years with a 3% rate of return compounded annually.)