Updates coming to Target Enrollment Date option in July (FAN Summer 2023)

In July, my529’s Target Enrollment Date (TED) option will see portfolio changes as part of its regularly scheduled asset allocation update.

While advisors are well-versed in target date portfolios, your clients may have questions. my529 notified account owners in the April newsletter and emailed a reminder in June.

Read on for more information about the TED updates and the timeline.

Updates are part of the plan

my529’s TED investment option includes 12 portfolios on a single glide path, with asset allocations that range from aggressive to conservative. The allocations adjust quarterly in a planned shift over time toward more conservative holdings.

By design, every two years the option will offer a new aggressive allocation and, at the other end of the glide path, the portfolio with the most recent date (e.g., 2020/2021) will be folded in to the Enrolled portfolio. This sort of movement from the most recent date TED investment option to the Enrolled portfolio does not constitute an investment option change.

Here’s what to expect

The changes detailed below are automatic. No action is required by account owners or advisors.

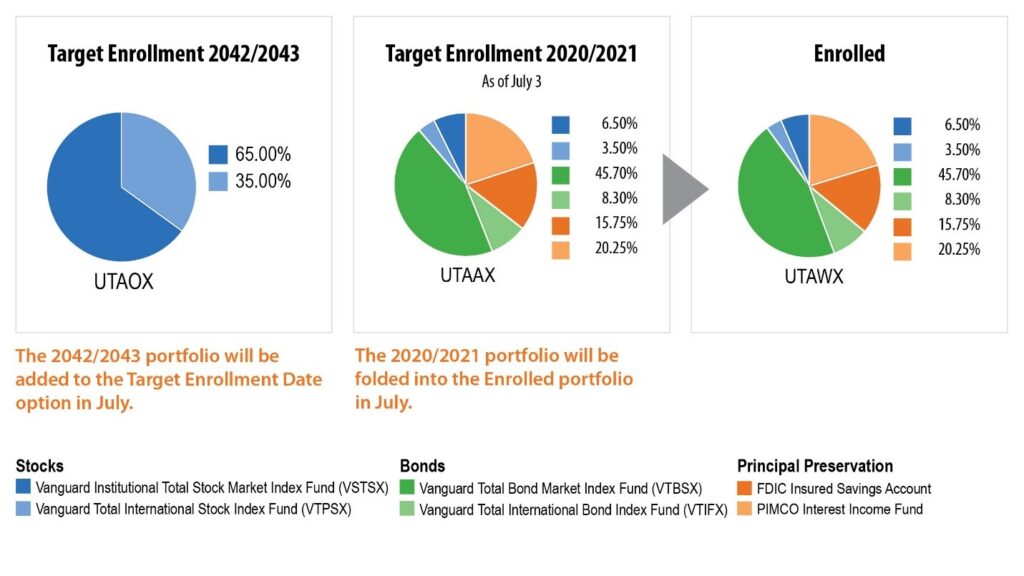

July 3: As is customary on the first business day of the quarter, my529 will make asset allocation adjustments to the TED portfolios as applicable. The quarterly change to the 2020/2021 portfolio will result in the asset allocation mirroring the Enrolled portfolio as displayed in the chart below.

July 10: The 2020/2021 portfolio will transition automatically into Enrolled. Account owners will see the transition in their online accounts and quarterly statements. The transition will not count as an option change.

July 10: my529 will offer a new 2042/2043 portfolio. This portfolio will be at the beginning of the glide path and will have an aggressive, equity-based construction. my529 will perform system updates beginning at 2 p.m. MT. You may have limited access to the advisor portal for a short time.

Be advised: The transition to Enrolled from 2020/2021 will not count as an investment option change. Should you wish to adjust a client’s portfolio before July 3 or after the shift to Enrolled, it will be considered an investment option change.

To review client accounts and investments, log in to your advisor portal at fa.my529.org.

Questions? We’re here for you. Contact the Professional Services T