Registered apprenticeships

Whatever your path, my529 can help

After high school, people have multiple paths available to them, including registered apprenticeships offered by technical education institutions.

Are any of these right for you? If so, my529 can help. Find out more in the resources below.

What is a registered apprenticeship?

Apprenticeship.gov defines an apprenticeship as “an industry-driven, high-quality career pathway where employers can develop and prepare their future workforce, and individuals can obtain paid work experience, classroom instruction, and a portable, nationally recognized credential.”

To qualify, the apprenticeship must be registered and certified with the Secretary of Labor under Section 1 of the National Apprenticeship Act. Each registered apprenticeship will specify the requirements for participation.

my529 funds can be used for registered apprenticeships, as well as the fees, books, supplies and equipment required to participate.

Apprenticeship resources

- Visit Utah Department of Workforce Services to learn more about apprenticeships in Utah.

- Apprenti-Utah, partnered with the Utah Technology Apprenticeship Program (UTAP), can provide information about apprenticeship opportunities.

- Search apprenticeship.gov, the official federal apprenticeship website, for information and resources.

- Explore opportunities locally with Talent Ready Utah to begin training for your career, whether you’re in high school or looking to change vocations.

Technical education institutions

Technical education is a popular avenue for postsecondary education, and my529 funds can be used as long as the school is qualified to participate in federal student aid programs. Contact your school of interest to determine their eligibility. Many options for technical education are available nationwide. Find a complete list of institutions, updated quarterly, at the U.S. Department of Education federal student aid site.

Utah has eight colleges and three degree-granting institutions that offer technical education within the Utah System of Higher Education:

What does current research say about registered apprenticeships and technical colleges?

Specialized trades offer solid skills and high starting salaries

The promises of trade school are working. The National Student Clearinghouse Research Center found student enrollment in vocational-focused (rather than transfer-focused) community colleges jumped by 17.6% from 2023 to 2024, on top of a 4% increase the prior year.1 Additionally, people who complete a registered apprenticeship earn an average starting salary of $80,000 and have a lifetime earning average of $300k over peers who don’t.2

Trade positions work well for individuals who are entrepreneurial and capable of promoting their services through social media and local marketing. If you have recently hired anyone for a renovation, you know that quality work generates enough positive word of mouth to book out months in advance, allowing tradespeople to control their calendars and benefit directly from their overtime efforts. Plus, students can earn money while attending apprenticeship programs, creating a longer runway for saving goals like retirement and their children’s 529 plans.

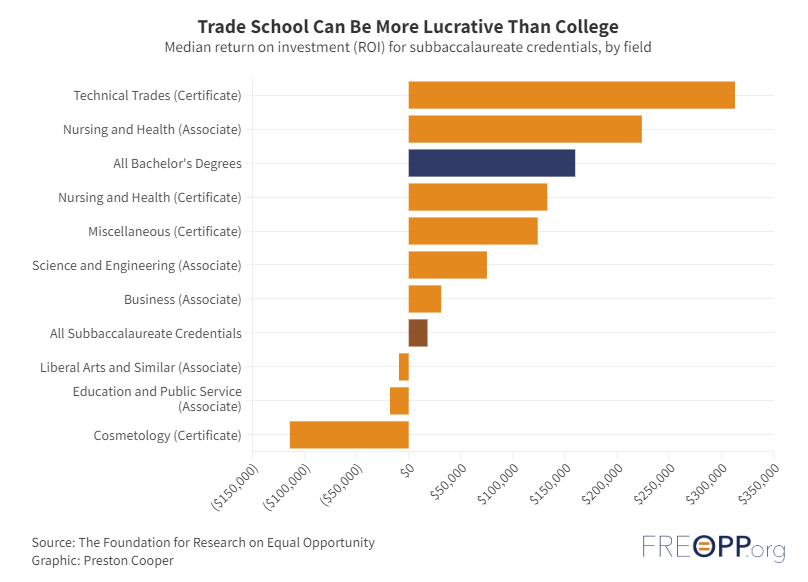

Gen Z prioritizes staying ahead of the AI learning curve to ensure their educational investments keep up with — and survive — technology improvements. Technical colleges help students learn entry-level skills, while also achieving higher average wages. The Foundation for Research on Equal Opportunity found “median ROI for the technical trades is $313,000, compared to just $160,000 for the median bachelor’s degree. Two-year degrees in nursing and other health professions also boast a strong median ROI of $224,000.”3

- “Current Term Enrollment Estimates | National Student Clearinghouse Research Center.” 2024. May 22, 2024. https://nscresearchcenter.org/current-term-enrollment-estimates/. ↩︎

- Apprenticeship, Office Of. 2024. “Apprenticeship.gov.” Apprenticeship.Gov. August 5, 2024. https://www.apprenticeship.gov/. ↩︎

- “Does College Pay off? A Comprehensive Return on Investment Analysis – FREOPP.” 2024. FREOPP. May 31, 2024. https://freopp.org/does-college-pay-off-a-comprehensive-return-on-investment-analysis-563b9cb6ddc5. ↩︎