Sharing the wealth

FOR IMMEDIATE RELEASE:

Contact: Bryn Ramjoue’, Marketing Director, 801.321.7161, press@my529.org

May 29, 2024

my529 passes on savings from fund’s share class change; 78% of account owners to save a collective $947,000 annually

(Salt Lake City) my529, Utah’s 529 educational savings plan, has long worked to provide a low-cost, high-quality savings plan for account owners in Utah and across the country. Good news for many account owners invested in the plan—those costs just dropped even lower.

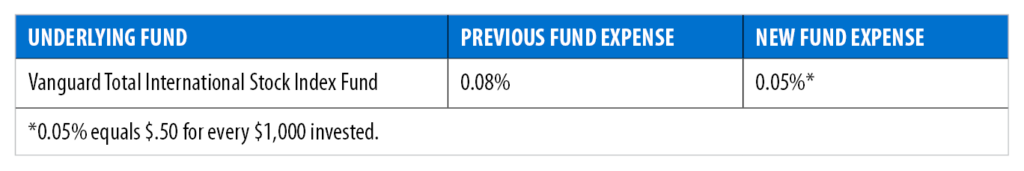

A Vanguard fund featured in several my529 investment options qualified for a new share class as of May 2, 2024, decreasing its underlying fund expense by three basis points. my529 is passing the savings on to its account owners.

It’s not just a handful of account owners who will benefit from this reduction—78% of my529 account owners are invested in an investment option containing the Vanguard Total International Stock Index Fund (VTPSX/now VTISX, following the change in share class). my529 estimates that these account owners will collectively save more than $947,000 annually.

The total value of the my529 Trust’s assets invested in the underlying fund has surpassed $3 billion, a threshold that qualifies my529 for a lower-cost share class. my529’s scale allows the plan to offer funds at a lower rate. For a my529 account owner, that could mean the ability to cover more of their beneficiary’s education expenses—and that’s what my529 is all about.

The my529 advantage

my529 pools together the money from account owner contributions to their 529 accounts and invests it in underlying investments. my529 owns these underlying investments in a public trust. Account owners do not own the underlying investments, but instead own units in the my529 investment options offered by the trust. The daily value of a my529 investment option unit is the pooled value of its underlying investments minus the daily accrual of expenses.

Pooled investments in the Vanguard Total International Stock Index Fund recently qualified for a less-expensive share class.

“Account owners invested in the fund through my529 will now pay an average of 58% less than what a retail investor would pay for the same fund,” said Richard Ellis, my529 executive director. “The savings investors realize through the new share class can increase their account’s potential for growth over time.”

The Vanguard Total International Stock Index Fund appears in all 12 my529 Target Enrollment Date portfolios, as well as in six Static investment options. The fund is available as a single-fund portfolio in the Customized investment options, the my529 Total International Stock Index (UTVIX).

Passing on savings to you

my529 consistently looks for opportunities to cut costs for account owners. With the shift to VTISX, my529 qualifies for the lowest-cost share class available for 18 out of 20 Vanguard funds used in my529 investment options.

The reduction in underlying fund expenses for the Vanguard Total International Stock Index Fund lessens the annual asset-based fee in investment options containing the fund, increasing the portfolio’s long-term potential for growth. See our fee schedules at my529.org.

“Vanguard has been a trusted fund partner with my529 since the late 1990s,” Ellis said. “Their team shares our values─offering high quality funds at the lowest possible cost. We explore every avenue to pass along savings to the investor.”

About my529

my529, Utah’s official nonprofit 529 educational savings plan, is highly rated by Morningstar Inc.

Accounts are free to open, and my529 requires no minimum deposit or account balance. my529’s user-friendly website, my529.org, makes it easy to open, manage, and contribute to an account online.

To learn more, visit my529.org, call toll-free at 800.418.2551, or email info@my529.org.

Important Legal Notice

Investing is an important decision. The investments in your account may vary with market conditions and could lose value. Carefully read the Program Description in its entirety for more information and consider all investment objectives, risks, charges and expenses before investing. For a copy of the Program Description, call 800.418.2551 or visit my529.org.

Investments in my529 are not insured or guaranteed by my529, the Utah Board of Higher Education, the Utah Higher Education Assistance Authority Board of Directors, any other state or federal agency, or any third party. However, Federal Deposit Insurance Corporation (FDIC) insurance is provided for the FDIC-Insured investment option. In addition, my529 offers investment options that are partially insured for the portion of the respective investment option that includes FDIC-insured accounts as an underlying investment.

The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds and protection from creditors, not otherwise available to you by investing in my529. You should consider such benefits, if any, before investing in my529.

my529 does not provide legal, financial, investment or tax advice. You should consult your own tax or legal advisor to determine the effect of federal and state tax laws on your particular situation.

A Morningstar Analyst RatingTM for a 529 college savings plan is not a credit or risk rating. Analyst ratings are subjective in nature and should not be used as the sole basis for investment decisions. Morningstar does not represent its analyst ratings to be guarantees. Please visit Morningstar.com for more information about the analyst ratings, as well as other Morningstar ratings and fund rankings.

Find out more

Learn about other college savings scholarship opportunities from my529.