You asked, we answered. Questions from our account owners.

my529 recently received feedback from surveys on account owner experience. We want to thank all who took the time to help us know how we can serve you better.

Account owners had varied comments and questions that we hope to answer in our newsletters. Read below about the number of investment option changes allowed and sending electronic payments to the beneficiary’s school.

Investment option changes

Several account owners asked why only two investment option changes are allowed per year.

my529 does not control the number of investment option changes account owners can make. Congress has set the number of annual investment option changes by statute, and my529 is required to adhere to that statute.

Something my529 does have control over are the investment options we offer—a variety from which account owners can select.

If you wish to make an investment option change, you can do so at my529.org or by submitting an Investment Option Change form (Form 405), which can be downloaded online.

To learn about investment option changes, read Part 7 (Investment Information) of the my529 Program Description.

Withdrawals sent to beneficiary’s school

Some account owners wondered why my529 does not allow electronic payment from their my529 account to a school.

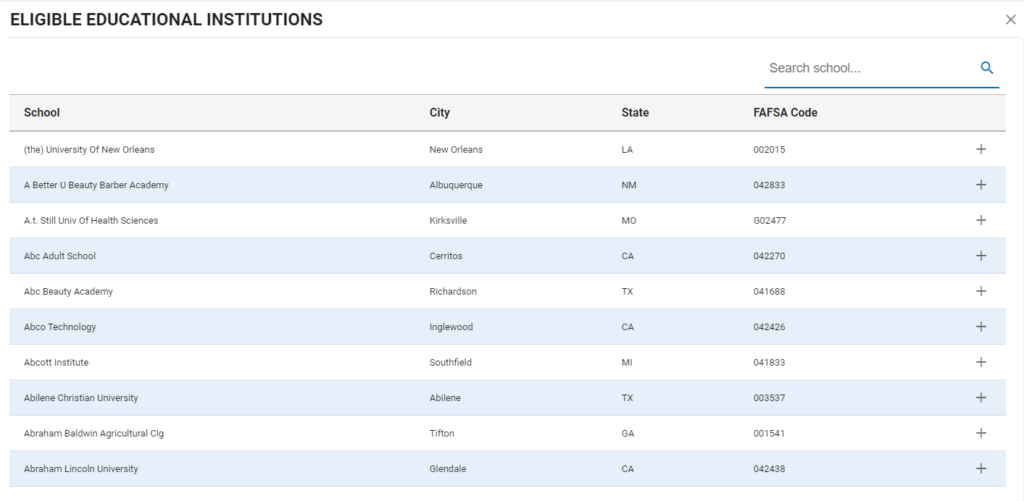

There are logistical challenges with sending electronic payments to the thousands of institutions of higher education in the U.S. and abroad, including the ability to ensure that the electronic payments are correctly applied to the appropriate beneficiary. Additionally, colleges and universities may periodically change their banks.

my529 allows account owners to have a check mailed to a beneficiary’s school. The account owner must submit all necessary information online at my529.org or on the Withdrawal Request (Form 300).

For more information on withdrawing funds, see Part 4 (Withdrawals) of the my529 Program Description, or go online to my529.org/other-essentials/withdrawing-your-funds/.

Find out more

Check out our Frequently Asked Questions page.