Investment Options

A diverse menu

my529 offers an array of investment options. Each option uses a different investment strategy. Choose the option that works best for you.

Target Enrollment Date

The Target Enrollment Date investment option consists of 12 Enrollment Date portfolios. Each two-year portfolio reallocates to a more conservative investment allocation each quarter. Use the slider below to see how allocations change every two years as your beneficiary ages closer to enrollment. You may select a portfolio closest to the year you anticipate the account beneficiary will begin taking withdrawals for qualified education expenses. If your risk tolerance is more aggressive or conservative, you may select a date further from the expected date of school enrollment (aggressive) or nearer to the expected date of school enrollment (conservative) to meet your needs.

Click on the chart below or drag the slider to explore the Target Enrollment Date portfolios.

Explore my529’s diverse investment options

Asset Allocations

Net Asset Value

Approximate Cost of a $10,000 Investment6

The Performance Summary data shown above reflect past performance and are not an indication or guarantee of future results. Investment returns and principal value will fluctuate with market conditions. Investments, when sold, may be worth more or less than the original cost; in short, your investment could lose value. Current performance may be lower or higher than the performance data cited.

Investment returns take into account the underlying investment performance for each period, including applicable interest and dividends, and are net of fees. Individual account performance will vary relative to the stated performance depending on the timing of buy and sell transactions within each account.

For the Target Enrollment Date investment option, the performance reflects changes in asset allocations over time relating to the target year the account beneficiary will begin withdrawing funds to pay for qualified education expenses.

The Approximate Cost of a $10,000 Investment table above compares the approximate cost of investing in my529 over different periods of time. The actual cost may be higher or lower. The table is based on the following assumptions:

- A $10,000 investment invested for the time periods shown.

- A 5% annually compounded rate of return on the amount invested throughout the period.

- All units are redeemed at the end of the period shown for qualified education expenses.

- The table does not consider the impact of any potential federal or state taxes on the redemption.

- Total annual asset-based fees remain the same as those presented in the my529 Asset Fee Structure Table in the Program Description and are reflected in this table as an annual fee assessed on the average yearly balance.

The Vanguard, Dimensional and PIMCO Underlying Fund Expenses apply to the Vanguard, Dimensional and PIMCO funds, respectively. There are no underlying investment expenses assessed on the assets invested in FDIC-insured accounts.

Notes

- Year-to-date calculations are based on a calendar year; January 1 to the current month-end date.

- Average annualized returns for investment options with an inception date in the past 12 months are cumulative and non-annualized.

- The inception date is the first date that (a) the investment option was offered and/or received a contribution.

- The estimated expenses for each investment option represent the weighted averages of the Underlying Fund Expenses of the applicable underlying investments in which each investment option is invested. The Underlying Fund Expenses for the individual mutual funds are listed in the Program Description and at my529.org. The Underlying Fund Expenses of the mutual funds are charged against the investments in the funds on a daily basis. There are no underlying investment expenses assessed on the assets invested in FDIC-insured accounts.

- This is also referred to as the Operating Expense Ratio.

- All my529 investment options that include the PIMCO Interest Income Fund as a component of the investment option will also have wrap and custody fees of 0.150%, which are charged by the wrap providers and are paid out of the PIMCO Interest Income Fund, but are not reflected in the estimated underlying fund expense ratio.

- The my529 Administrative Asset Fee is 0.090% annually (0.0075% per month), charged as described under the my529 Administrative Asset Fee section in the Program Description.

12 Target Enrollment Date portfolios

- Select a portfolio for when the beneficiary begins taking withdrawals.

- Built from mix of:

- Vanguard mutual funds.

- PIMCO Interest Income Fund.

- FDIC-insured accounts.

- Based on preset quarterly investment allocation schedule.

- Portfolios gradually shift to more conservative allocations.

- Eventually end up in Enrolled portfolio.

- Two option changes allowed per year.

- View/download a PDF pie chart of the Target Enrollment Date portfolios.

Static Options

Static investment options remain in the stated allocations for the life of the account. However, you can request an option change and move your invested funds into another option. You can make only two option changes per calendar year. Click on the chart below or drag the slider to compare allocations.

Explore my529’s diverse investment options

Asset Allocations

Net Asset Value

Approximate Cost of a $10,000 Investment6

The Performance Summary data shown above reflect past performance and are not an indication or guarantee of future results. Investment returns and principal value will fluctuate with market conditions. Investments, when sold, may be worth more or less than the original cost; in short, your investment could lose value. Current performance may be lower or higher than the performance data cited.

Investment returns take into account the underlying investment performance for each period, including applicable interest and dividends, and are net of fees. Individual account performance will vary relative to the stated performance depending on the timing of buy and sell transactions within each account.

For the Target Enrollment Date investment option, the performance reflects changes in asset allocations over time relating to the target year the account beneficiary will begin withdrawing funds to pay for qualified education expenses.

The Approximate Cost of a $10,000 Investment table above compares the approximate cost of investing in my529 over different periods of time. The actual cost may be higher or lower. The table is based on the following assumptions:

- A $10,000 investment invested for the time periods shown.

- A 5% annually compounded rate of return on the amount invested throughout the period.

- All units are redeemed at the end of the period shown for qualified education expenses.

- The table does not consider the impact of any potential federal or state taxes on the redemption.

- Total annual asset-based fees remain the same as those presented in the my529 Asset Fee Structure Table in the Program Description and are reflected in this table as an annual fee assessed on the average yearly balance.

The Vanguard, Dimensional and PIMCO Underlying Fund Expenses apply to the Vanguard, Dimensional and PIMCO funds, respectively. There are no underlying investment expenses assessed on the assets invested in FDIC-insured accounts.

Notes

- Year-to-date calculations are based on a calendar year; January 1 to the current month-end date.

- Average annualized returns for investment options with an inception date in the past 12 months are cumulative and non-annualized.

- The inception date is the first date that (a) the investment option was offered and/or received a contribution.

- The estimated expenses for each investment option represent the weighted averages of the Underlying Fund Expenses of the applicable underlying investments in which each investment option is invested. The Underlying Fund Expenses for the individual mutual funds are listed in the Program Description and at my529.org. The Underlying Fund Expenses of the mutual funds are charged against the investments in the funds on a daily basis. There are no underlying investment expenses assessed on the assets invested in FDIC-insured accounts.

- This is also referred to as the Operating Expense Ratio.

- All my529 investment options that include the PIMCO Interest Income Fund as a component of the investment option will also have wrap and custody fees of 0.150%, which are charged by the wrap providers and are paid out of the PIMCO Interest Income Fund, but are not reflected in the estimated underlying fund expense ratio.

- The my529 Administrative Asset Fee is 0.090% annually (0.0075% per month), charged as described under the my529 Administrative Asset Fee section in the Program Description.

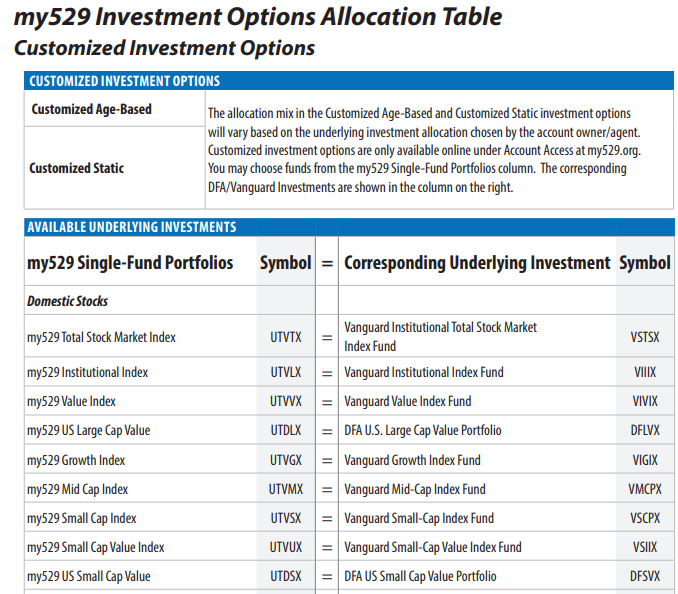

Customized Age-based

The Customized Age-Based investment option allows you to determine and create your own investment allocation using any combination of the available my529 single-fund portfolios for each of 10 age brackets.

You determine and customize the investment allocation for each of 10 age brackets: 0-3, 4-6, 7-9, 10-12, 13-14, 15, 16, 17, 18, 19+. Money in the account will be rebalanced annually on your beneficiary’s birthday to bring the underlying investments back to the target allocation that you chose when you created this option.

Money invested in the Customized Age-Based option automatically reallocates to the new investment allocation that you have chosen when your beneficiary ages to the next bracket.

Consult your financial advisor before investing. If you do not fully understand the decisions you are making by selecting either customized investment option, you should consider whether this option is an appropriate choice.

Customized Static

The Customized Static investment option allows you to determine and create your own investment allocation using any combination of the available underlying funds.

This option will not change as your beneficiary ages, unless you request an investment option change. Money in the account will be rebalanced annually on your beneficiary’s birthday to bring the underlying investments back to the target allocation that you chose when you created this option.

Consult your financial advisor before investing. If you do not fully understand the decisions you are making by selecting either customized investment option, you should consider whether this option is an appropriate choice.

About underlying investments

Depending on which investment option you select for your account, my529 pools your investment in a combination of Vanguard Group and Dimensional Fund Advisors mutual funds, the PIMCO Interest Income Fund, or the FDIC-insured accounts held in trust at Sallie Mae Bank and U.S. Bank. Collectively, these funds and accounts are referred to as underlying investments. Learn more about our underlying investments.

The my529 account owner owns units of the investment option issued by the my529 Trust. The my529 account owner does not own shares of any underlying investment.

Allocation tables for my529 investment options

For a side-by-side comparison of our options, please review the underlying fund allocations for all of my529’s Enrollment Date portfolios and Static investment options. You can also view the funds available for the Customized options.