A five-year savings incentive program for Utah families

Welcome to my529’s incentiFive — your family’s ticket to future educational adventures!

As a Utah parent, you have a unique opportunity to plan for your child’s future with a rewarding savings program designed just for Utahns. By contributing just $100 a year for five years, you can unlock up to $929 in special incentive contributions to help your little one soar toward their academic dreams.

It’s more than a savings account; it’s a chance to create a habit of saving for education while getting a little help along the way.

Small steps, big future

Kickstart your child’s education savings journey with the my529 incentiFive Program, where saving money can be as exciting as watching your little one grow!

To participate in the incentiFive Program, you must be a Utah resident over the age of 18 with a child who qualifies for the program.

Contribute a minimum of $100 each year for five years, and my529 will match that $100 each year for the first four years, with a grand finale of $529 placed in your my529 account in year five! That means $1,429 put toward your child’s education by the time they reach kindergarten!

If your child is born between September 1, 2025, and August 31, 2026, you can enroll in incentiFive by either opening a my529 account, or connecting an existing my529 account, through the incentiFive portal. (Note: The portal is only accessible using the Google Chrome browser.) Please remember to make your $100 minimum contribution to the account by December 31, 2026.

| Year | Minimum account owner contribution requirement | my529 contribution to your account |

|---|---|---|

| 2026 | $100 | $100 |

| 2027 | $100 | $100 |

| 2028 | $100 | $100 |

| 2029 | $100 | $100 |

| 2030 | $100 | $529 |

Incentive contributions will be fulfilled on or about two weeks after the quarter in which the $100 minimum is reached for the year. (Quarters end March 31, June 30, September 30 and December 31.) See incentiFive FAQ or Terms and Conditions for more details.

New to my529?

Take your first steps toward saving

Gather necessary documentation

Have the following on hand before you open an account:

- Account Owner: Social Security Number/Taxpayer Identification Number and a Utah physical address.

- Beneficiary: Social Security Number/Taxpayer Identification Number, birthdate, and a U.S. physical address.

- Successor Account Owner (optional): Social Security Number/Taxpayer Identification Number and birthdate.

- Contributions: Account and routing numbers for your bank or credit union.

Carefully read the my529 Program Description and the incentiFive Program Terms & Conditions before you open an account and participate in the program.

Before you open a my529 educational savings account, please carefully read the relevant documents in their entirety to understand the risks associated with investing in my529.

In order to open an account with or connect an account to the incentiFive Program, you must do so via the official incentiFive Program portal, linked below.

(Note: The portal is only accessible using the Google Chrome browser.)

Have an existing account or opening one via Form 100?

Choose an investment strategy

my529 has a variety of investment options — Target Enrollment Date, Static and Customized. Underlying funds include offerings from Vanguard, Dimensional, PIMCO and FDIC-insured accounts.

Make a contribution

You can contribute to your my529 account in several different ways.

- Online through my529.

- Online through your bank or credit union.

- Bill pay.

- Payroll Contribution.

- By Gift.

- Rollover.

Have questions?

We’re happy to help

Reach out to us at marketing@my529.org, call us at (800) 418-2551, or head over to our FAQ to learn more.

Why save early?

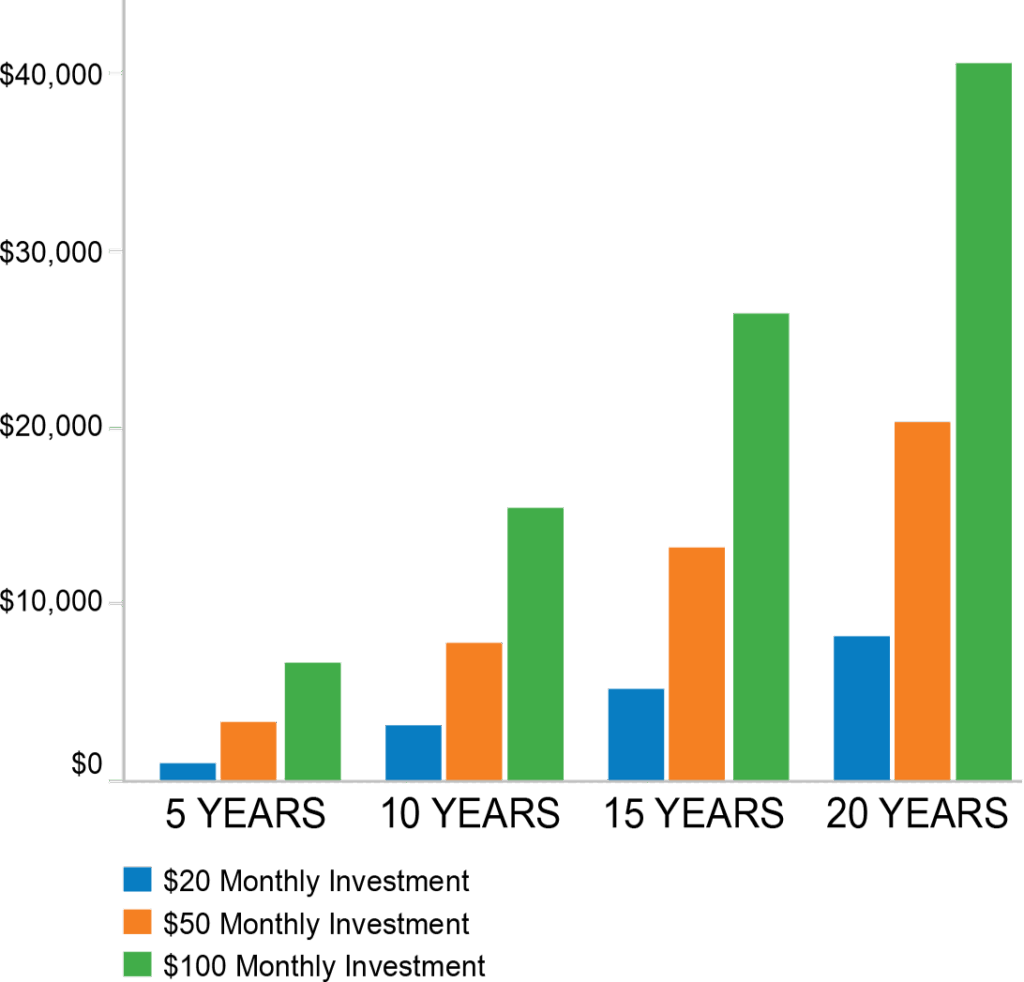

Contributions can add up. A small investment now may help your loved ones achieve their future educational dreams.

This scenario is for a my529 account with a beginning balance of zero dollars and the amount stated contributed on the first day of each month over various time periods, with a 5% rate of return compounded annually. This chart is for illustrative purposes only.

Setting up recurring contributions

You schedule your bills to auto pay each month, why not set up a recurring contribution for your child’s higher education savings, too? In just 10 minutes you can set up a monthly contribution to ensure you meet the required incentiFive Program’s $100 annual contribution requirement.

Visit our contributions page for more information or to enroll in automatic contributions.

Want to share incentiFive info with a group or new parent in your life? Check out these helpful postcards!