Help your clients with Gen Z dependents explore various higher education paths

High school graduates have more education options than ever, and with that increased variety, your savvy clients want to be certain that their investments of time and money will pay off. Market factors like artificial intelligence are reconfiguring the workforce, leading many recent high school graduates to consider apprenticeships, trade schools, technical colleges and additional cost-saving methods for achieving degrees.

With this article, you can become a guide for your client, helping them navigate current ROI rates across various modern paths to career training, minimizing their higher education costs — and maximizing their investments.

Being a mentor during the ‘decisive decade’

Between constantly evolving technology, the cost of education, and the truly countless paths available to students today, there are multiple strategies for success.

For high schoolers, the strongest factors that lead to socioeconomic upward mobility are family structure, religious and civic participation, and strength of their K-12 school system. Students who are happier in their teen years have higher earnings, more quality relationships and are more civically engaged and integrated with society.1

Future outcomes are forged between the ages 14-24, a time known as the “decisive decade.” During this period students navigate from one growth opportunity to another and experience brain development around decision making and risk-taking to help shape their futures.2

Recent high school graduates get to use their newfound agency to make important choices, but can still benefit from mentors who have experienced many of these decisions and can offer new perspectives when weighing pros and cons.

Mentors are critical in young people’s lives and can significantly influence their success when they assist with hurdles, such as applying for school, filling out their FAFSA, or meeting with the student and parent to explain the ROI on higher education (e.g., sharing this story). The important social and relationship bonds strengthened during these interactions help link students to future social ties.

This is where you can be a valuable resource! Your clients may feel overwhelmed by the cost of higher education and the diverse options. As their advisor, you can help guide them among the following academic choices to find the perfect fit, exploring various paths with demonstrable ROI for the student. Then, when that student has graduated and is embarking on their own career, they may be inclined to reconnect with their trusted mentor as a trusted financial advisor.

The conventional wisdom and tradition is “you graduate from high school and go to a four-year university.” That wisdom doesn’t reflect current data or career outcomes. You can share the following research on ROI across various paths to higher education that your clients may not have considered.

Specialized trades are offering solid skills and high starting salaries

The promises of trade school are working. The National Student Clearinghouse Research Center found student enrollment in vocational-focused (rather than transfer-focused) community colleges jumped by 17.6% from 2023 to 2024, on top of a 4% increase the prior year.3 Additionally, people who complete a registered apprenticeship earn an average starting salary of $80,000 and have a lifetime earning average of $300k over peers who don’t.4

Trade positions work well for individuals who are entrepreneurial and capable of promoting their services through social media and local marketing. If you have recently hired anyone for a renovation, you know that quality work generates enough positive word of mouth to book out months in advance, allowing tradespeople to control their calendars and benefit directly from their overtime efforts. Plus, students can earn money while attending apprenticeship programs, creating a longer runway for saving goals like retirement and their children’s 529 plans.

Technical colleges deliver strong ROI

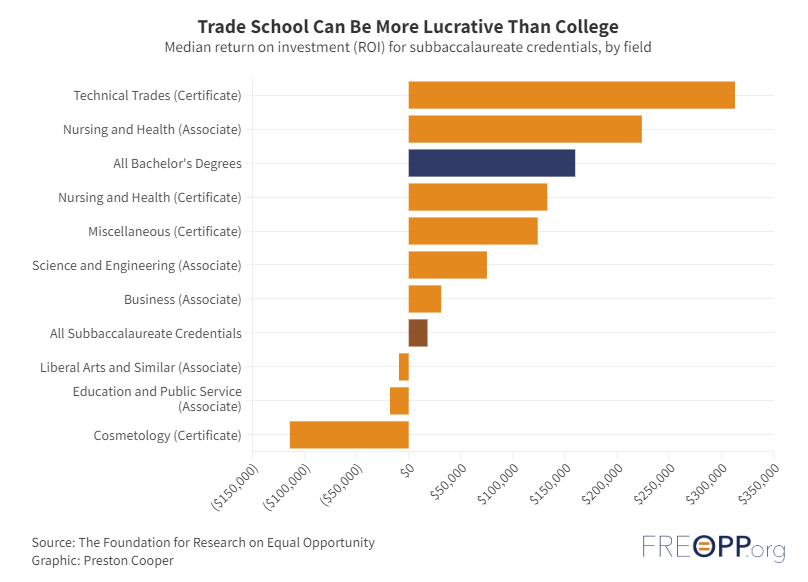

Gen Z prioritizes staying ahead of the AI learning curve to ensure their educational investments keep up with — and survive — technology improvements. Technical colleges help students learn entry-level skills, while also achieving higher average wages. The Foundation for Research on Equal Opportunity found “median ROI for the technical trades is $313,000, compared to just $160,000 for the median bachelor’s degree. Two-year degrees in nursing and other health professions also boast a strong median ROI of $224,000.”5

The Utah Foundation examined long term value of higher education programs over 40 years and Neumont College of Computer Science surpassed all other Utah schools.6 Attending a technical college allows students to skip general education classes and jump straight to building on marketable skills, empowering them to take on paying projects or internships simultaneous to completing their coursework, all while still enjoying the social and extracurricular opportunities a school campus offers.

Not all four-year degrees break even, but some majors offer dependable returns

Four-year universities are seeing their enrollment numbers drop and are concerned about continuing to attract new students, but they aren’t dead yet! With careful consideration, students can choose an undergraduate major that will reliably pay off.

A recent Salt Lake Tribune study of 656 occupations across 22 industries tracked earnings over an individual’s career and the range is significant. Over a 20-year career, these numbers accumulate to a range of $577,408 to $1,962,883. In addition to illustrating the benefits of a bachelor’s degree, the Tribune study also reinforced that not every well-paying job requires a bachelor’s degree. “An associate’s degree can also be lucrative in the health care field — like magnetic resonance imaging technologists, who make a median annual wage of $78,000.”7

Not all degrees are equal, but regardless of degree choice, starting at a community college can help boost returns by keeping costs low. Not only do students have the opportunity to experience greater variety during their education, but the final diploma will be no different — and cost less. Attending summer school at community college or earning college credit during high school can shave off semesters or help a student narrow their academic focus. Classes that aren’t completed or don’t apply to their ultimate degree may be the costliest.

How long until they can expect to break even?

Higher education is an expensive endeavor, but the rewards exceed purely financial gains to include intellectual, social and societal benefits. Those qualitative factors are important for your clients to consider, but you can offer customized insights into the quantitative variables thanks to some useful tools.

The Foundation for Research on Equal Opportunity did extensive reporting on the rate of return across various certificates and degrees, and your clients may find their interactive graphs helpful. You can utilize the drop downs to isolate the majors your clients are considering and see the dispersion of earnings, including what percentage of those degree owners never achieve a positive ROI.8 If you wish to explore these resources, they can be found in the endnotes.

Clients can also explore average outcomes across specific majors at various schools with Georgetown University’s ROI calculator.9 Paired with the my529 College Savings Estimator tool, students can use these resources to capture a clear picture of anticipated total costs against the predicted future earnings of individual programs. This will help ensure that their investments of time and money are well spent, as almost one third of higher education students are enrolled in programs that are unlikely to pay off.

With so much research available to parents and students today, the options can be overwhelming without a trusted guide. Deciding on a perfect path for higher education is a very personal choice for any student, but your valuable insights about programs or majors will do well to help your client set their student up for success down the road — when hopefully they will return as a client themselves!

[1] Chetty, Raj, Matthew O. Jackson, Theresa Kuchler, Johannes Stroebel, Nathaniel Hendren, Robert B. Fluegge, Sara Gong, et al. 2022. “Social Capital I: Measurement and Associations With Economic Mobility.” Nature 608 (7921): 108–21. https://doi.org/10.1038/s41586-022-04996-4.

[2] Smith, Ember, and Richard V. Reeves. 2024. “The Decisive Decade: Understanding the Trajectories of 14- to 24-year-olds.” Brookings, April 26, 2024. https://www.brookings.edu/articles/the-decisive-decade-understanding-the-trajectories-of-14-to-24-year-olds/.

[3] “Current Term Enrollment Estimates | National Student Clearinghouse Research Center.” 2024. May 22, 2024. https://nscresearchcenter.org/current-term-enrollment-estimates/.

[4] Apprenticeship, Office Of. 2024. “Apprenticeship.gov.” Apprenticeship.Gov. August 5, 2024. https://www.apprenticeship.gov/.

[5] “Does College Pay off? A Comprehensive Return on Investment Analysis – FREOPP.” 2024. FREOPP. May 31, 2024. https://freopp.org/does-college-pay-off-a-comprehensive-return-on-investment-analysis-563b9cb6ddc5.

[6] “Bang for Your Buck: Which Utah Schools Have the Best Return on Investment – Utah Foundation.” 2023. Utah Foundation. August 29, 2023. https://www.utahfoundation.org/reports/bang_for_your_buck_return_on_investment/.

[7]The Salt Lake Tribune. 2024. “These College Majors Give Utah Students the Most (and Least) Returns Over Their Career,” May 2, 2024. https://www.sltrib.com/news/2024/05/02/picking-college-major-heres-how/.

[8]“Does College Pay off? A Comprehensive Return on Investment Analysis – FREOPP.” 2024. FREOPP. May 31, 2024. https://freopp.org/does-college-pay-off-a-comprehensive-return-on-investment-analysis-563b9cb6ddc5.

[9] “A First Try at ROI: Ranking 4,500 Colleges – CEW Georgetown.” 2024. CEW Georgetown. May 8, 2024. https://cew.georgetown.edu/cew-reports/collegeroi/.

From the FAN — Summer 2024