5·29 Day 2025

Celebrate 5·29 Day with my529, Utah’s educational savings plan

For more than 25 years, my529 has been helping families save for education — be it for college, university, trade school, technical college or graduate school.

We support National 5·29 Day with a promotional offer to encourage Utah residents to mark the occasion to kick-start an investment in the future.

A $40 promotion

To be eligible to receive a $25 matching contribution from my529, open an account for a beneficiary who is new to my529 and contribute $25 or more to the new account between May 1 and May 31, 2025. Use the code 529DAY25 during the account setup process. my529 will match the $25 contribution on or around June 16, 2025. Account owners must be Utah residents. The beneficiary does not need to be a Utah resident.

For an additional $15 from my529 — a total of $40 including the initial $25 match — the account owner must set up scheduled monthly contributions on the new account. The recurring contribution must occur for six consecutive months to be eligible. my529 will contribute $15 to qualifying accounts on or around December 31, 2025, so long as promotional funds are available.

RECEIVE $40 FROM MY529

+Open a my529 account.

+Contribute $25 or more.

+Use code 529DAY25.

+Set up scheduled monthly contributions.

Signing up is easy

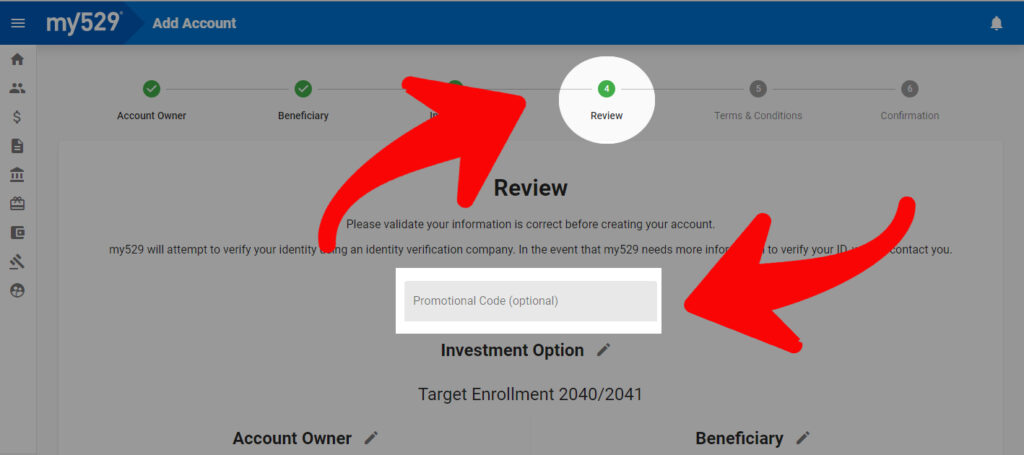

If you are signing up for an account online, enter your promotional code on step four of the account opening process, where you review your information. You can schedule contributions during the online process.

Why open a my529 account?

529 plans are designed to encourage saving for future education costs. They are sponsored by states, state agencies, and educational institutions, and are authorized by Section 529 of the Internal Revenue Code.

my529, Utah’s official nonprofit 529 educational savings plan, is rated by Morningstar Inc. as one of only two plans nationwide to earn the Analyst Rating™ of Gold. The 2024 award marks the 14th consecutive year my529 has earned the investment research firm’s top rating.

You’re in control

- Direct-sold — you can open a my529 account on your own.

- Account owners control their accounts — not the beneficiary.

Tax advantages

- Earnings in a my529 account grow tax-deferred.

- Withdrawals are tax-free if used on qualified education expenses.

- Utah state tax credit for Utah taxpayers.

Estimate your costs

Don’t let the news about rising higher education costs overwhelm you. Saving small amounts early and often can add up over time and you can use my529’s College Savings Estimator to investigate various projections for future college costs. Customize your inquiries — in-state, public, private — or even specific schools and generate a personalized report with separate tabs for each future graduate.

How and where to use my529 funds

my529 funds can be used for qualified education expenses such as tuition and required fees, books, equipment, computers, internet access and room and board (for students enrolled at least half time). Additionally, funds can be spent on registered apprenticeships, student loan repayments up to certain limits, and K-12 tuition expenses up to $10,000 annually for public, private or religious schools.

When it’s time for postsecondary education, the use of my529 funds is not limited to Utah schools. Beneficiaries can attend any eligible educational institution in the United States or abroad that is qualified to participate in federal student aid programs.

Eligibility and rules

Employees of my529, the Utah Board of Higher Education, the Utah Education Savings Board of Trustees, and their immediate family members are not eligible for this offer. my529 will make deposits into qualifying accounts on a first-come, first-served basis for as long as the promotional funds are available. This promotion is void where prohibited by law. my529 reserves the right to stop the promotion at any time and for any reason.

New Individual Account Agreements and contributions submitted by mail, fax, overnight carrier or in person must be received between May 1 and May 31, 2025, by 5 p.m. MT. Accounts opened and contributions made online at my529.org must be received between May 1 at 12:01 a.m. and May 31, 2025, by 11:59 p.m. MT. Documentation must be in good order to process and receive the match. This promotion applies only to my529 accounts that are opened by Utah residents between May 1 and May 31, 2025, in recognition of 5·29 Day.

There is no cost to open a my529 account, and all ongoing fees are described in the my529 Program Description, available at my529.org. Please consult your tax advisor about the tax implications of participating in this promotion. Visit my529.org or call 800.418.2551 for more information.