Updates coming to TED option in July

On July 1, 2025, my529’s Target Enrollment Date (TED) investment option will see portfolio changes as part of its regularly scheduled asset allocation update.

Updates by design

my529’s TED investment option has 12 portfolios on a single glide path, where asset allocations range from aggressive to conservative. Allocations adjust quarterly in a planned shift over time toward more conservative holdings as the account approaches the beneficiary’s target date for enrollment.

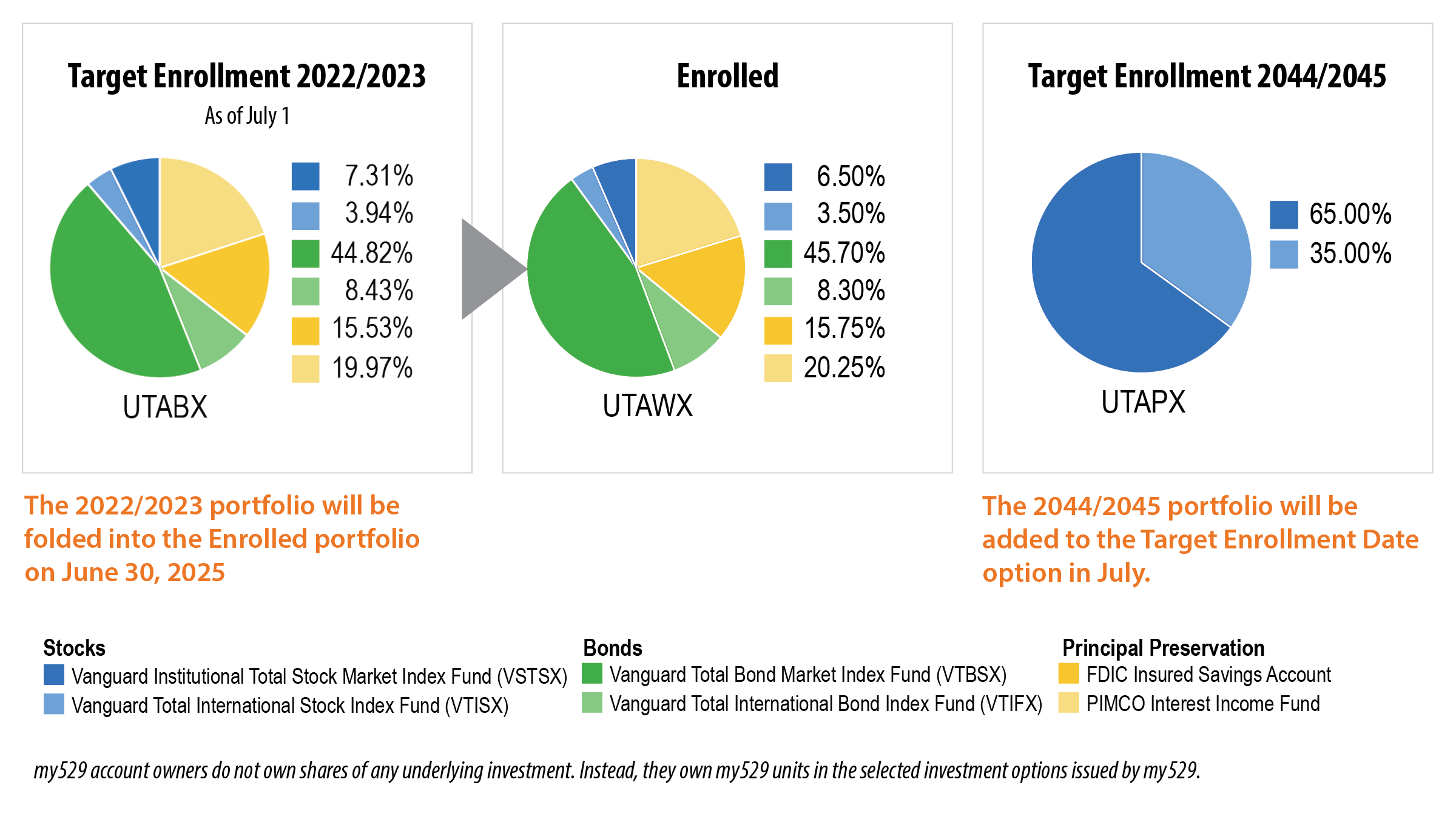

Every two years, the TED investment option offers a new aggressive allocation and, at the other end of the glide path, the portfolio with the most recent date (e.g., 2022/2023) will be folded into the Enrolled portfolio. Visit my529.org’s Investment Options page to see the full allocation chart.

Here’s what to expect

The changes are automatic. No action is required by account owners.

June 30

The 2022/2023 portfolio will be shifted automatically into Enrolled. Account owners will see the transition in their online accounts and quarterly statements. The transition will not count as an option change.

my529 will perform system updates beginning at 2 p.m. MT, so you may have limited access to your online account for a brief period.

July 1

my529 will offer a new 2044/2045 portfolio. This portfolio will be at the beginning of the glide path, with an aggressive, equity-based construction.

The transition of 2022/2023 to Enrolled will not count as an investment option change. If you would like to adjust your portfolio before or after June 30, it will be considered an option change. The Internal Revenue Code limits account owners to two investment option changes per calendar year.