Adding convenience for your clients (FAN Fall 2023)

my529 unveils two new withdrawal offerings

The new features provide security and convenience when clients access the funds they have been saving for years.

Advisors cannot manage these functions on behalf of their clients. However, please inform your clients that these convenient tools may give them peace of mind when withdrawing their money for qualified education expenses.

Electronic payments to schools coming this fall

New functionality for your clients

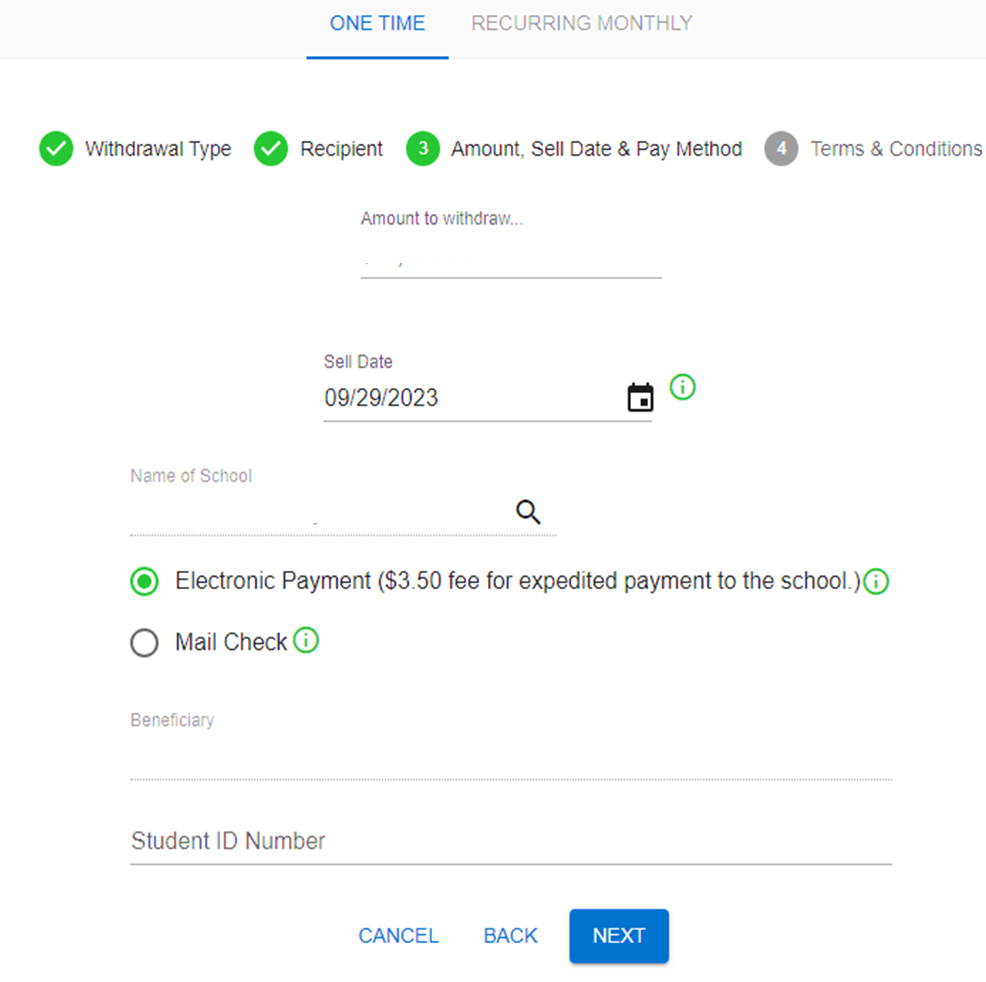

Introducing my529’s direct-to-school payment service that allows account owners to send an expedited withdrawal to a participating higher education institution. It’s fast, convenient and trackable.

Secure electronic payments arrive at the institution within approximately two to three business days. Account owners can even monitor the status of a payment.

The functionality costs $3.50 per transaction. The service fee will be added to the withdrawal amount and deducted from the my529 account.

K-12 schools are not eligible.

Can advisors perform electronic payment withdrawals?

The electronic payment service is not available in the FA portal or to advisors or RIAs with limited power of attorney access. Account owners must request a withdrawal themselves within their online account. This process cannot be completed via paper form.

A new way to pay: the my529 Access Discover® Prepaid Card

The my529 Access Card is a prepaid card that can be used at select merchants for in-store or online purchases where Discover is accepted. The card provides a simple way to access money invested in a my529 account.

Funds can be withdrawn online from an account owner’s my529 account and transferred to their my529 Access Card. After that, users are able to click, swipe, or tap the card to use the money when paying for fees, books, supplies, and other qualified education expenses.

The my529 account owner controls the Access Card account. Once funds are transferred to the my529 Access Card, they are considered withdrawn from my529 and are no longer invested in the account owners’ my529 accounts.

The my529 Access Discover® Prepaid Card is issued by Central Bank of Kansas City, Member FDIC. Discover and the Discover acceptance mark are service marks used by Central Bank of Kansas City under license from Discover Financial Services. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and Fee Schedule at http://my529accesscard.com. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us 24/7/365 toll-free at 1-844-545-0805.