Navigating uncertain markets

An interview with my529’s executive director

Richard Ellis, my529 executive director, sat down to answer some of the frequently asked questions about keeping perspective in a time of market fluctuations.

Market ups and downs

Rarely do both stocks and bonds post negative returns at the same time, but 2022 was one of those years, Ellis said, noting it has only occurred three or four other times in a span of 120 years.

Generally, the trend goes that if stocks are down, bonds are up. Not in 2022, where they “moved in tandem,” Ellis said. “They have both lost money, so that makes it a unique year, where we would expect stock market losses to be tempered by some positive returns in bonds, but it’s exasperated the volatility because both of them have had negative returns.”

When the market fluctuates

A good practice for account owners is to evaluate their individual situation each year, regardless of the market. Consider how much risk you can tolerate, Ellis said, the age of the beneficiary, and when you need to count on being able to use the funds.

Assess your risk tolerance

Every individual has a different risk tolerance and should consider their investment accordingly, said Ellis. At my529, we “have tried to develop investment options that meet people along the continuum.”

Investment option change

After reflection, some account owners may determine it is prudent to make an investment option change. The IRS allows two option changes per calendar year.

While my529 does not offer investment advice, there are some factors to weigh prior to making an investment option change. Account owners may want to look at the beneficiary’s age and the amount of time before they may need to make a withdrawal. Investment option changes could lock in losses, depending on how long the money has been invested.

For example, “If I’ve got a 15-, 16-, or 17-year-old, I probably can’t handle a lot of volatility, and I might look at doing an investment option change to something more conservative,” Ellis said.

“If I have a newborn or a three-year-old, I still have 15 years, and, historically, markets have had positive returns, so I have time for things to recover,” he said.

“Frequent evaluations of risk tolerance and time horizon are important, along with asking if you are in the right investments for where you are in life,” Ellis said.

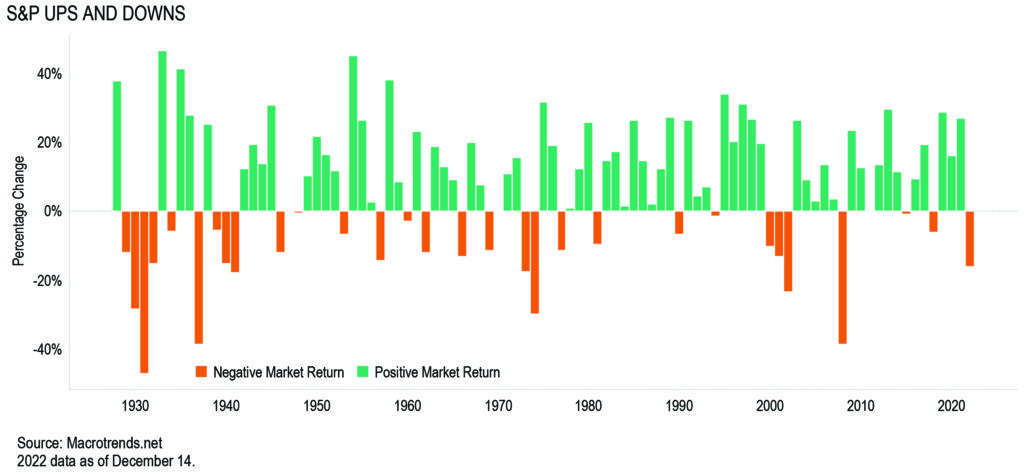

“Negativity in the market tends to be relatively short-lived, though it may not feel that way. The annual returns of the S&P 500 from 1928 to November 2022 may provide some comfort,” Ellis said. In that 94-year span, there were only four times where the index had negative returns for two consecutive years or more.

However, if you need the funds relatively soon, the idea of a potential market rebound may not ease the sting of a downturn that affects your investment.

Investing with my529

Ellis emphasizes that the investment options my529 offers are investments, which differ from savings.

What 529 plans do is create securities that are sold to the public, and the securities are investments.

“Investments will lose money, and they’ll gain money. It’s all a matter of when you get in and when you get out, so there’s risk associated with that,” Ellis said.

While the nature of investments inherently involves risk, it also provides the possibility for reward.

“Obviously, I think 529 plans are a great way for people to invest for education. Most importantly, start early, because that’s where you get the greatest benefit. It’s because of time, the potential appreciation of equities (stocks) over the long term—and tax advantages that accrue to your benefit—they all make a 529 plan a great consideration for future education costs.”

In our April newsletter, you can read Part 2 of our conversation about my529 and the market, investment options, and historic market cycles.

Investment advice

my529 account owners often ask why they cannot get advice about what to do with their investments from my529 directly. Ellis explained that my529 investments are a municipal fund security.

“We aren’t a registered broker/dealer, and [our] employees cannot be licensed to give advice,” he states. “We cannot be in the business of giving advice, only general information.”

Richard K. Ellis

Executive Director and former senior director for compliance, communications, finance and investments, my529; former Utah state treasurer; former Utah chief deputy state treasurer; former director, Governor’s Office of Planning and Budget, Utah Govs. Olene S. Walker and Jon M. Huntsman Jr.; former member, Municipal Securities Rulemaking Board (MSRB); former president, National Association of State Treasurers (NAST) and Utah Retirement Systems Board of Trustees; former second vice president, National Association of State Auditors, Comptrollers and Treasurers.