How my529’s investment options respond to the market

An interview with my529’s executive director

In our January 2023 newsletter, my529 Executive Director Richard Ellis answered some frequently asked questions about market fluctuation. This is a continuation of our discussion about my529 and the market below.

my529’s investment options are built with index funds, which track market indexes like the S&P 500 and the Russell 3000.

“The expectation [with index funds] is that you’re going to get market returns—if the market’s up, you’re up. If the market’s down, you’re down,” Ellis said. “But you should be very close to what that index return is.”

Index investment options are a less-expensive way of getting market exposure for your investment, Ellis said. Typically, passively managed funds have outperformed actively managed funds over time, which is why my529 built investment options using index funds.

“When an account owner looks at their statement and says, ‘I have less money today than I had a year ago,’ put it in context: You’re in an index fund that replicates the market; therefore, you’re going to have losses that mirror what the market has lost.”

While some account owners think my529 actively manages funds, that is not the case. The reality is that my529 has designed a variety of asset allocations that provide diversity, with certain options configured to reduce risk around the time beneficiaries need the funds for qualified expenses.

“But essentially, you’re going to get market returns using index funds,” Ellis said. At my529, our philosophy is that, over time, index funds will outperform actively managed funds.

my529 doesn’t offer any truly actively managed funds, Ellis said, though there are some Dimensional Fund Advisors funds within the Customized options menu that provide an element of it.

Review your resources

Account owners should review their individual situations and risk tolerance, and evaluate the resources available to pay for college, especially, as Ellis said, if a beneficiary turns 18 and enrolls in college during a volatile market year. Perhaps delaying withdrawals for a short period might allow some time for the market (and your account) to recover.

“Is there another way to pay for college so you don’t lock in the loss? Can you get by for a year or two before you have to draw that money down?” Ellis said.

Historic fluctuations

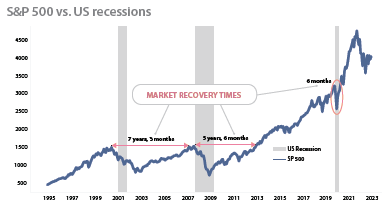

There have been several years of economic downturn in recent memory. The 2008 housing market crash is not too far in the rearview mirror, and the economic effects of the Covid-19 pandemic are still being felt. While the pinch may feel similar, Ellis said, these two events, from an economic perspective, involve very different circumstances.

The 2008 housing crisis was the result of money being too easy to borrow and people buying houses they could not afford. In contrast, with the onset of the pandemic in March 2020, the equity markets reacted to the shutdown of activities, but they quickly recovered.

To combat the effects of the pandemic-related shutdown, the federal government enacted programs to try to stimulate the economy by flooding the market with money. This resulted in inflation and raising the debt of the federal government.

“We are living through what we created by stimulating the economy,” said Ellis.

Ellis emphasized that the economy always goes in cycles. Sometimes those cycles are four years, while other times those cycles are 10 years, but the basics remain similar.

“Realize that markets will go up and will go down. We have to have a long-term vision about what our investment is going to be,” Ellis said.

Looking forward

“Past performance is no predictor of future performance, so next year could be a negative return, too. But looking over the time frame of (nearly 100 years to now), it’s not often that we see back-to-back negative returns in the stock market. This time may be different, but it’s something to look at and say, what does this trend look like historically?” Ellis said.

Investment advice

my529 account owners often ask why they cannot get advice about what to do with their investments from my529 directly. Ellis explained that my529 investments are a municipal fund security.

“We aren’t a registered broker/dealer, and [our] employees cannot be licensed to give advice,” he states. “We cannot be in the business of giving advice, only general information.”

Read the first part of the interview with my529 Executive Director Richard Ellis.

Investment advice

my529 account owners often ask why they cannot get advice about what to do with their investments from my529 directly. Ellis explained that my529 investments are a municipal fund security.

“We aren’t a registered broker/dealer, and [our] employees cannot be licensed to give advice,” he states. “We cannot be in the business of giving advice, only general information.”

Richard K. Ellis

Executive Director and former senior director for compliance, communications, finance and investments, my529; former Utah state treasurer; former Utah chief deputy state treasurer; former director, Governor’s Office of Planning and Budget, Utah Govs. Olene S. Walker and Jon M. Huntsman Jr.; former member, Municipal Securities Rulemaking Board (MSRB); former president, National Association of State Treasurers (NAST) and Utah Retirement Systems Board of Trustees; former second vice president, National Association of State Auditors, Comptrollers and Treasurers.