Student Prosperity Savings Program

Contribute to students’ future success

The Utah Legislature has created the Student Prosperity Savings Program, a vehicle for community organizations to provide my529 college savings accounts for low-income students.

my529 professes, as part of its motto, “Save for College. Inspire Their Future.®” We serve families and beneficiaries who are saving for college, with a goal of putting higher education in reach.

For children of families living in intergenerational poverty, however, college dreams may require more than their means can cover.

What is the program?

The Student Prosperity Savings Program was created by the Utah Legislature with HB24 of the 2017 session. The program allocates funding to nonprofit community partners for the purpose of opening children’s savings accounts (CSAs) at my529 for economically disadvantaged students. Students must attend college, university, or technical college within three years of graduating high school to use the funds to help pay for the costs of their higher education.

Roles and responsibilities

my529

- Reviews applications and allocates program funding to community partners.

- Provides the CSA investment account setup and recordkeeping system.

- Reports outcomes to the Legislature.

Community partners

- Design a program to mentor students and reward them for completing educational milestones.

- Outline a plan for implementation and administration of the program.

- Submit application to my529 for funding.

- Potentially contribute to the accounts.

- Monitor student progress and report to my529.

Eligibility

Students

To be eligible, the student must be:

- younger than 20 years old and a Utah resident.

- receiving or have a family member, a foster family member, or a legal custodian or legal guardian who is receiving services from a community partner.

- “Economically disadvantaged,” which means that a child is:

- experiencing intergenerational poverty.

- a member or foster child of a family with an annual income at or below 185 percent of the federal poverty level, or

- either living with a legal custodian or legal guardian with an annual family income at or below 185 percent of the federal poverty level, or living with a legal custodian or legal guardian who can attest that the child or the child’s household is receiving services benefitting low-income households or individuals.

Community partners

- Must be a nonprofit organization that provides services to a child who is economically disadvantaged or a family member, legal guardian or legal custodian of a child who is economically disadvantaged.

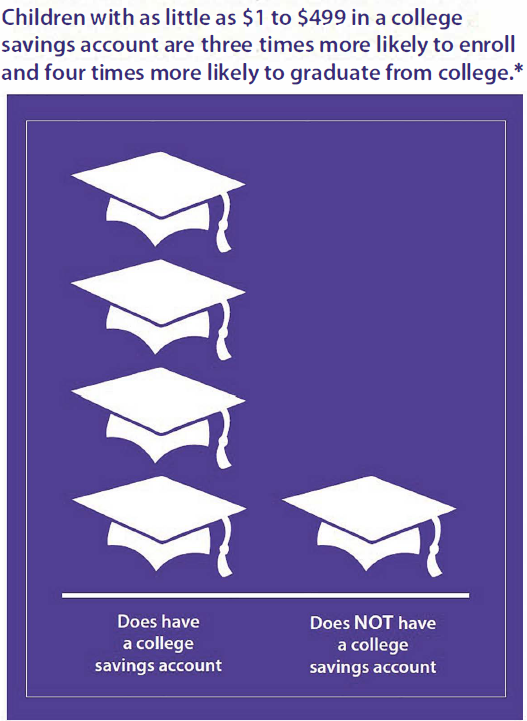

Savings impact

The Student Prosperity Savings Program changes lives by providing college savings seed funding to students who have experienced intergenerational poverty.

Having a college savings account is a primary indicator in shaping college-bound identity. Even accounts with small balances make a difference. Low- to moderate-income youths who hold a savings account designated for education with a balance of between $1 and $500 are four times more likely to graduate from college than their peers who do not have such savings. Educational savings fosters a child’s development of an identity that “people like me go to college.”

The Student Prosperity Savings Program is a community-driven, state-supported initiative, relying on support of government, nonprofits, schools, institutions of higher education, community foundations, businesses, philanthropic partners, and individual donors.

Where the money goes

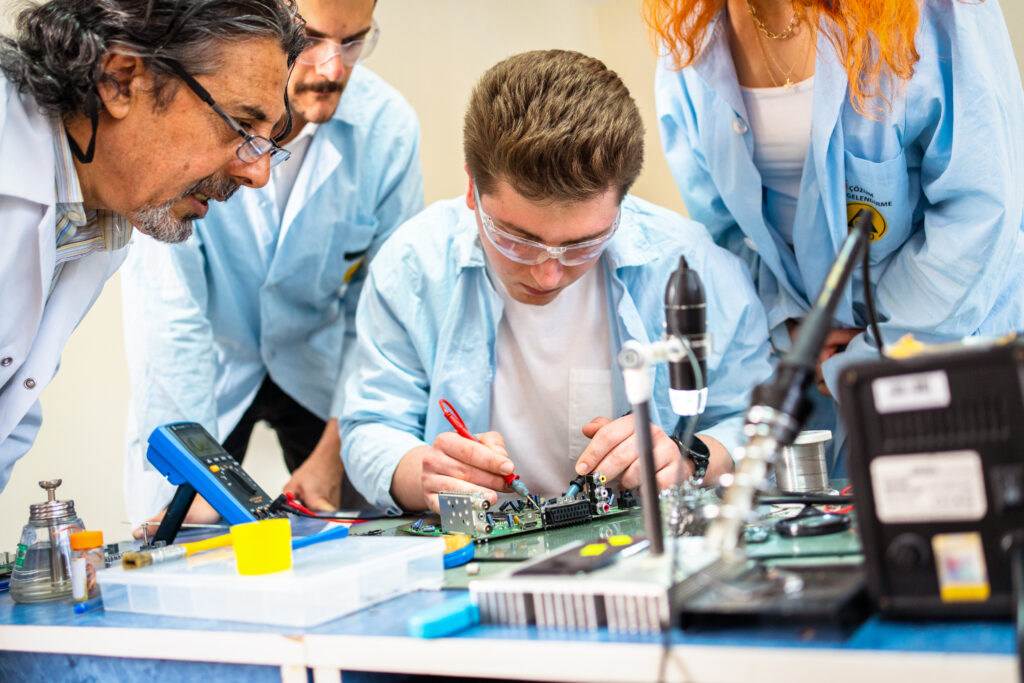

Students can use funds for college classes, either while working toward a degree or taken individually. Also, funds can go toward a certificate from Utah College of Applied Technology and registered apprenticeship programs.

Want to learn more?

For more information and questions, email studentprosperity@my529.org. For information on some of our other programs, check out our dedicated CSA page.