A plan for future educational goals

What is a 529 plan?

529 plans are sponsored by states and educational institutions, and are authorized by Section 529 of the Internal Revenue Code.

Watch this basic primer on saving for college with a 529 plan.

Benefits of my529

529 plans provide important advantages.

- Earnings aren’t subject to federal or state tax when used for qualified higher education expenses, such as:

- Tuition and mandatory fees.

- Computers, peripheral equipment, educational software, and internet access.

- Books, supplies, and required equipment.

- Room and board for students enrolled at least half-time.

- Tax advantages. Utah taxpayers who are account owners can receive a tax credit for contributions to their my529 accounts up to a certain limit.

- Not just for Utah. my529 funds can be used nationwide at any college, university, or trade or technical school that is eligible for federal financial aid.

Other resources

- Contests and scholarships. Utah students can enter one of our annual contests for a chance to win a $2,000 college savings scholarship account.

- College Savings Estimator. Planning for your child’s higher education, but not sure where to start? my529 works with Invite Education to provide a free financial calculator to help you plan.

Children naturally explore the world around them. Consider investing with my529 to help your kids go wherever their exploration takes them.

A special offer for Ogden Nature Center members

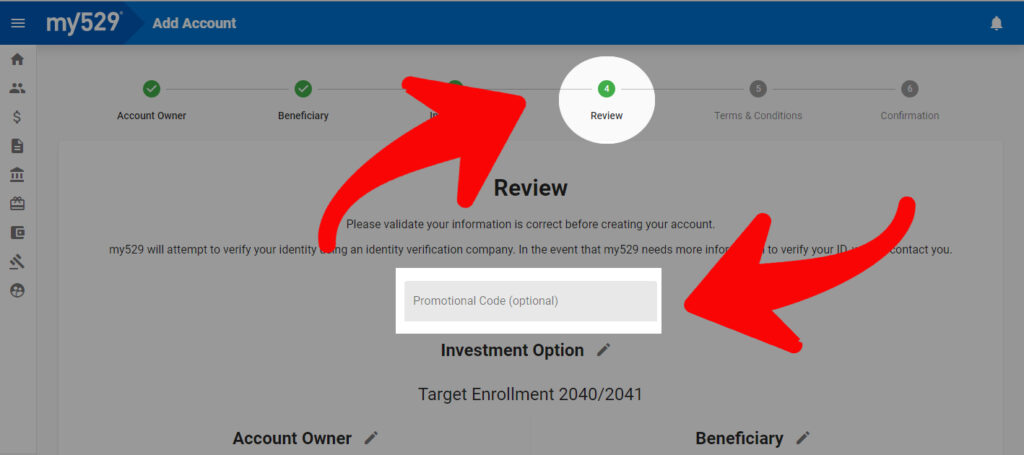

If you are a Utah resident and open a new my529 account for a beneficiary new to my529 between January 1, 2026, and December 31, 2026, and contribute at least $20 at opening, we’ll add a $20 contribution. Just use the promo code 2026ONC as shown below.

NOTE: Prior to December 31, 2025, the previous year’s code, 2025ONC, will still be active.

How to get the match

- Open a my529 account between January 1, 2026, and December 31, 2026.

- Enter promotional code 2026ONC.

- Contribute at least $20.

- my529 will deposit $20 into your new account.

To qualify, the account owner must be a Utah resident and the beneficiary must be new to my529.

Enter your promotional code on step four of the account opening process, where you review your information.