Estate Planning Tools for Financial Advisors

Estate planning with my529

Did you know that a my529 account can help with estate planning?

529 accounts have unique features that you can use as you advise your clients on saving for college, investing and estate planning.

Using the gift tax exclusion to superfund a client’s account

Did you know that your clients can superfund their accounts to help build a legacy of education? Superfunding allows a lump-sum gift of five years’ contribution to a beneficiary of up to $90,000 (or $180,000 if married and filing a joint tax return) without creating a taxable gift. Superfunding requires IRS Form 709, which allows the gift to be treated as a series of five equal contributions (e.g., $18,000 each, for a total of $90,000; $36,000 each, for a total of $180,000, if married and filing a joint return). No further contributions can be made until the sixth year.

If the IRS increases the annual gift exclusion, the tax filer can make a supplemental contribution equal to the difference between the old and new gift exclusion for each year still remaining in the five-year period. Refer to the Tax Considerations section of the Program Description for more information.

Although money held in an account is not considered part of the account owner’s estate, the account owner retains control of those contributions. As a result, gift tax and generation-skipping transfer tax rules apply. Consult a tax advisor regarding generation gift tax consequences for your clients.

Saving for education for the next generation

The benefits of a my529 account do not need to stop at graduation. Creating the habit of saving may be a difficult task, but it’s also crucial in taking advantage of the benefits of a my529 account. Encouraging your clients to maintain that savings habit after graduation could be key to achieving their family’s future educational goals.

Here are a few ideas your clients could use to build a legacy of education:

- Change the beneficiary of their my529 account. If the new beneficiary belongs to the family of the current beneficiary, the account will not incur federal or Utah state income tax consequences. Please see the Program Description for details regarding who qualifies as a “member of the family.” However, there could be a generation-skipping tax consequence for changing your client’s beneficiary.

- Grow their my529 savings for the next generation as an investment in the educational future of your client’s family by contributing to the account with the intent of providing funds for future beneficiaries.

- Protect their my529 assets by denoting a trust as the account owner or as a successor. Within your client’s trust, they will be able to detail use of their my529 funds for qualified education expenses and designate future beneficiaries, ensuring a legacy of education for years to come (Form 102).

Navigating client family events like divorce or death

Life transitions can be emotionally difficult for your clients. Here are a couple of steps you can take to secure a client’s my529 account in case of a life event necessitating a transfer of account ownership.

- Prepare the my529 account by having a primary successor — either an individual or trust (Form 515).

- Set up an interested party.

Here are some steps you can take to guide your clients through a major life event:

- Inform my529 of the event (at 888.529.1886 or advisorinfo@my529.org) which will allow us to safeguard the account during the ownership update process.

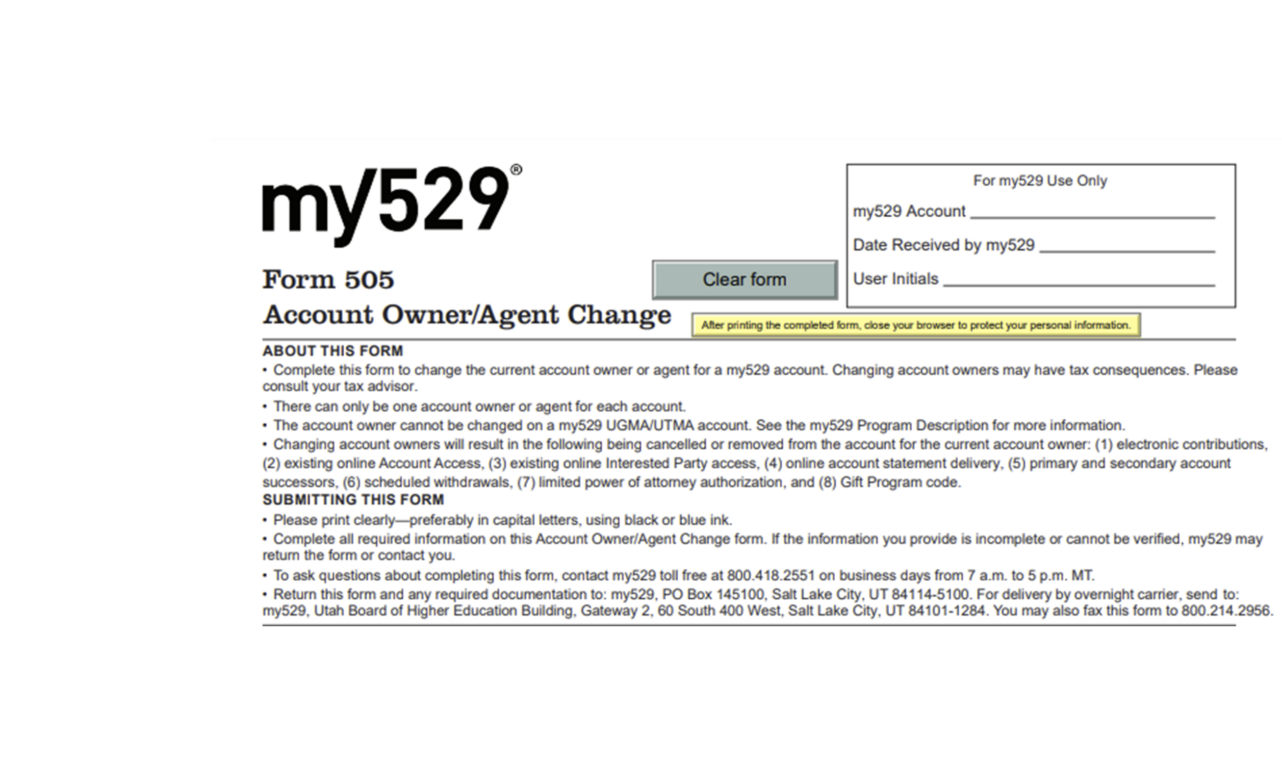

- Change account ownership (Form 505) and provide necessary documentation.

- Update your individual LPOA authorization after the account owner has been changed (Form 710).

For more details, see our library of estate planning articles below.

Want to learn more?

Contact the relationship management team by emailing us at advisorinfo@my529.org or booking a meeting on our Calendly page.

Read more about estate financial planning and 529s

-

What drives the next generation of financial planners?

We recently had the pleasure of interviewing Lexi Shipley, president of the Personal Financial Planning Student Association (PFPSA) at Utah […]

-

Help your clients with Gen Z dependents explore various higher education paths

High school graduates have more education options than ever, and with that increased variety, your savvy clients want to be […]

-

Financial planning for children with special needs

my529 met Neil Mahoney at a recent event where he presented on the topic of financial considerations for families with […]

-

What to do if a my529 account owner dies

Helping your clients manage the financial aspects of a loved one’s passing can be a difficult task. If the deceased […]

-

Divorce: How advisors can help their clients navigate this transition

Navigating clients through a divorce can be complicated and challenging for financial advisors. You may have clients with my529 accounts […]