Changes coming to two my529 Customized portfolios

Funds to change

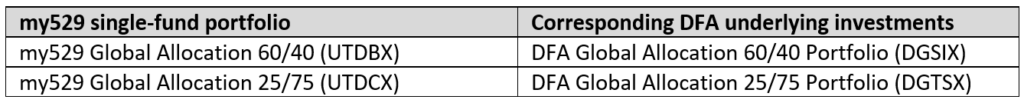

As of July 10, 2023, my529 will no longer offer the my529 Global Allocation 60/40 and 25/75 single-fund portfolios below, which correspond to the Dimensional Fund Advisors (DFA) underlying investments listed next to them.

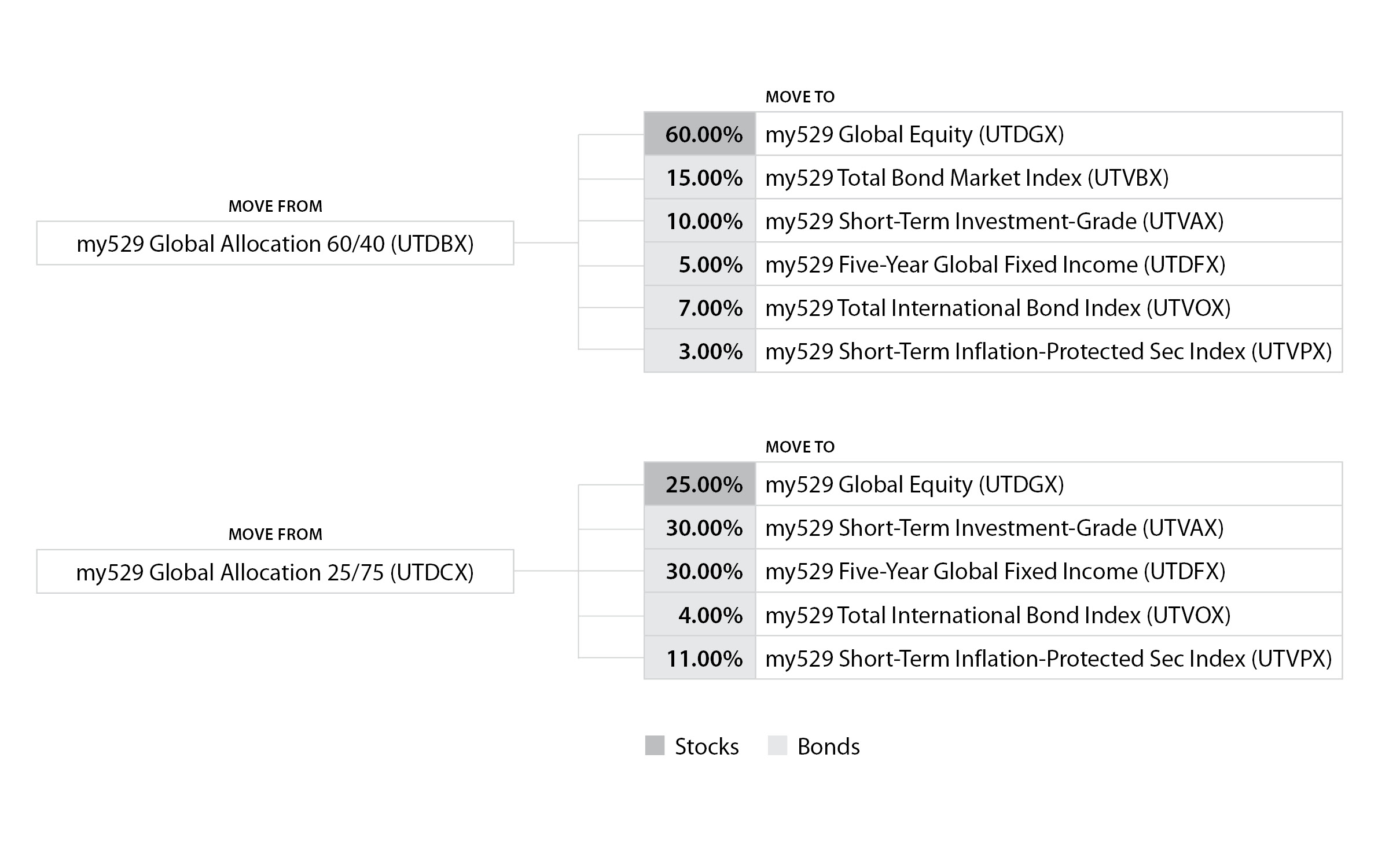

Assets will be mapped automatically on July 10 to similarly constructed portfolios

my529 will map assets automatically on July 10 to a group of existing single-fund portfolios with a similar makeup of underlying investments and allocations. The underlying investments include two DFA funds and several Vanguard funds. Following the transition to the new portfolios, underlying fund expenses will drop.

See the mapping lineup below.

What if I already hold one of the funds involved in the fund mapping?

If an account owner already holds any of the portfolios included in the fund mapping, the allocation transferred from either the my529 Global Allocation 60/40 or 25/75 portfolios will be added to the existing allocation.

Why is the change happening?

- The objective of the Customized investment options is to provide a variety of funds from which account owners can choose as they build a customized portfolio. The my529 Global Allocation 60/40 and 25/75 portfolios have proven to be two of the least popular funds in the Customized allocations. We have concluded that these multi-fund portfolios don’t fit the philosophy of the Customized offerings.

- my529 offers similar multi-fund options—in terms of equity/fixed income allocations—in the Static category at a lower cost. However, these multi-fund options offer Vanguard, PIMCO stable value and FDIC-Insured underlying funds rather than DFA.

Fees will drop

The underlying fund expense for the my529 Global Allocation 60/40 portfolio is currently 0.240%. After the transition, the expense will be 0.175%, a 27.3% reduction.

The underlying fund expense for my529 Global Allocation 25/75 portfolio is 0.250%. After the assets are mapped to the new funds, the expense will be 0.151%, a 39.7% reduction.

What do I need to do?

Nothing. This change will occur automatically and does not require any action on your part.

Will the mapping count as an investment option change?

No, it will not count as an investment option change.

However, if you would like to alter your allocations prior to or after July 10, it will be considered an investment option change.

The Internal Revenue Code allows you to change your investment option twice during a calendar year. Should you wish to adjust your Customized allocations, you may do so in your online account.

Questions?

Contact my529 by phone at 800.418.2551 or by email at info@my529.org.

For financial advisors

How will the change affect templates?

Any template including the former blended portfolios will remain active. Clients invested in the portfolios will have their holdings mapped automatically to the new portfolios. Additionally, the mapping will be included in the updated version of the template, and the template name will not change. You will still be able to view it in the advisor portal.

Be aware that after July 10, if you wish to use a template that includes one of the discontinued portfolios, you will be unable to do so. You will need to download and submit a printed version of the updated template with account applications.

If you have questions about the templates, please reach out to the Professional Services Team at 888.529.1886 or advisorinfo@my529.org.

More information

Check out my529’s investment information to learn more about our investment options.