Advisor tools

Benefits for your clients

By encouraging clients to invest with my529, you are showing them your commitment to building a thoughtful education investment portfolio. You are also demonstrating your sound financial judgment, not only with investing, but also with tax policy and fee management.

Key benefits of my529:

- Diversified, low-cost investment options using Vanguard and Dimensional funds, and FDIC-insured accounts.

- Tax-deferred growth.

- Tax-free withdrawals for qualified higher education expenses, including K-12 tuition expenses.

- No minimum investment requirements or startup fees.

- Easy online and automated contribution options.

- Simple rollover process.

- Utah state income tax credits for Utah taxpayers.

Benefits for advisors

my529 has many ways to assist you in guiding your clients toward their goal of saving for qualified higher education expenses, including K-12 tuition expenses.

Key features:

- Open accounts online for multiple clients at the same time.

- Limited power of attorney allows you to view and manage accounts. Set it up for clients at the same time you open their my529 accounts.

- Data integration solutions allow you to seamlessly link your client’s my529 account to your portfolio management system.

- Powerful online access simplifies the process.

- A robust set of investment options, including customizable investment options, allows you to effectively guide your clients as they choose their best investment strategy.

- Customized calculator makes it easy to build education investment portfolios and save templates for future clients.

- Forms and documents can be completed online or downloaded as PDF files.

- A Relationship Management Team to assist you is only a phone call away at 888.529.1886.

- my529 earned Morningstar’s Analyst Rating™ of Gold for 2024. It was the 14th straight year my529 won Morningstar’s highest honor.

Estate planning with my529

Did you know that a my529 account can help with estate planning?

529 accounts have unique features that you can use as you advise your clients on saving for college, investing and estate planning.

See our Estate Planning page for more information on helping your clients with:

- Using the gift tax exclusion to superfund their account.

- Saving for education for the next generation.

- Navigating client family events like divorce or death.

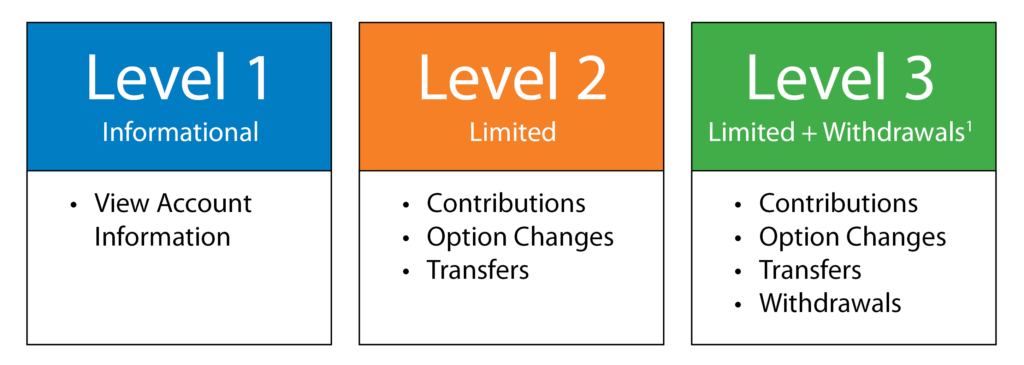

Limited power of attorney access levels

The account access granted by an account owner/agent to a financial/tax advisor is limited to the authority as shown.

1Withdrawal checks may be made payable only to the account owner, the beneficiary, or an eligible educational institution. my529 will not issue checks to other parties. Account owners can link a bank account to receive electronic deposits from my529 account withdrawals initiated online by financial advisors.