my529 – From humble beginnings to national honors

Explore the history of my529 and how it grew to serve over 600,000 accounts today.

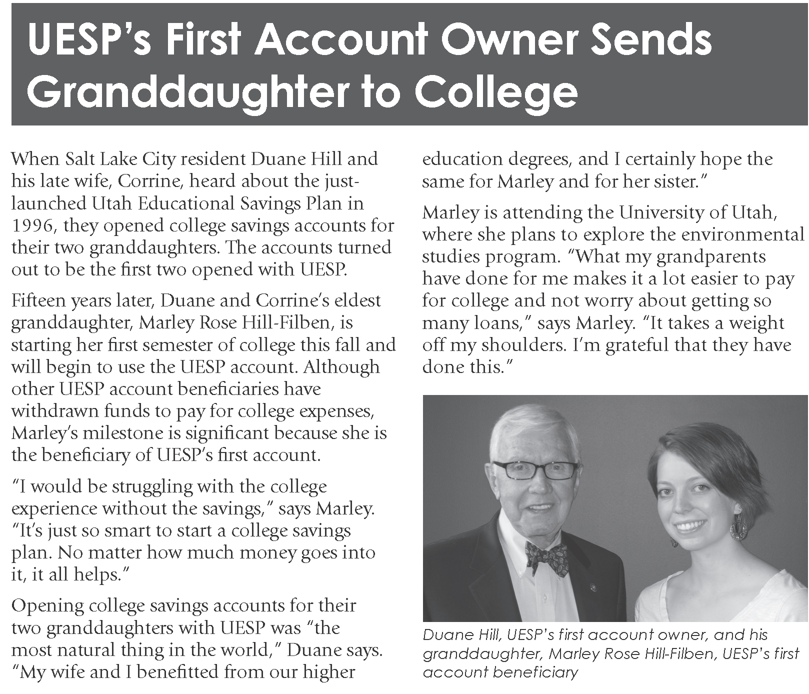

Carol Withrow can call herself a trailblazer. On the last day of 1996, with her grandson’s future in mind, Withrow opened a college savings account with the Utah Educational Savings Plan.

Her account was one of just 157 UESP accounts opened in 1996, mere months after the Utah Legislature established the new tax-advantaged, state-sponsored college savings plan qualified under Section 529 of the U.S. Internal Revenue Code.

Withrow created the account to help with the future college expenses of her first grandchild, Scott Hilton, who was 6 years old at the time.

“I guess I’m part of a unique crowd,” Withrow said.

Withrow’s continued funding of the account over decades helped Hilton further his education beyond high school.

“It’s a good resource to have, and it’s nice to know it’s there,” Hilton said of the account his grandmother established when he was a child and when UESP was just a newborn.

He is one of tens of thousands of beneficiaries over nearly three decades who have pursued higher education goals with the help of Utah’s official and only 529 college savings plan.

UESP®

UESP outgrew its formative years to reach the top tier of the nation’s 529 plans. It even outgrew its name.

At the end of 1996, UESP had just $200,000 under management in a handful of accounts owned by Utah residents. Today, Utah’s plan manages more than $29 billion total in over 600,000 accounts. Owners live in every U.S. state. Because of its national reach, UESP changed its name to begin doing business as my529 in 2018.

The new name eliminated any confusion about the plan’s mission. 529 plans — investment vehicles designed for educational savings — help people save for university, college or technical school. Funds can be used at any institution of higher education nationwide or abroad that accepts federal financial aid, and they’re not restricted to schools in Utah.

529 funds also can be used for K-12 expenses at public, private and religious schools, as well as for the costs of registered apprenticeships and certified postsecondary credentialing.

For the past 15 years straight, my529 has received the highest rating from investment research firm Morningstar Inc., validation that Utah’s 529 plan is one of the best.

my529 offers account owners convenient online access. The website my529.org features information and interactive tools to assist families and individuals in planning for future education costs, and to help investors determine saving and contribution levels necessary for various educational objectives.

“It’s been wildly successful. Nobody even talked about a billion dollars in those days,” said Edward Alter, who served as treasurer of the State of Utah from 1981 to 2009. Alter once chaired my529’s Investment Advisory Committee and also sat on the board of directors that oversees my529.

More important to Alter is how my529 has improved the lives of thousands of Utah students.

“I think it’s definitely helped people save for college,” he said. “There is no doubt in my mind that more kids are going (to college), and they are coming out of school with less student loan debt than they would have.

“Clearly, it’s helped people,” Alter said.

Before all that success, many things fell in place to give my529 its beginnings.

How 529 plans came to be

The drive to help families save for college arose in response to escalating tuition. Over the past 50 years, tuition has consistently increased at two to three times the rate of inflation, according to the College Savings Plans Network (CSPN), which represents 529 plans. In the late 1980s, states such as Florida and Michigan developed prepaid tuition plans out of concern for families struggling with the burden of financing their children’s higher education without relying on loans.

The movement gained speed in 1994, when a U.S. Court of Appeals upheld the tax-exempt status of Michigan’s prepaid tuition program. Two years later, a bipartisan effort in Congress to provide federal tax relief for state-sponsored plans resulted in the creation of Section 529 of the Internal Revenue Code. It permitted tax-deferred treatment of account earnings if used to pay for qualified higher education expenses. In 2001, qualified withdrawals became exempt from federal income taxes for a limited time, and in 2006, Congress made the federal tax exemption permanent.

Utah waits, then acts

During the early 1990s, Utah policymakers had watched as students and families in other states flocked to their state-sponsored plans, but they weren’t sure how Utah should proceed. These early programs were prepaid plans that only locked in future tuition costs at state colleges and universities and did not cover other costs.

Alter said those plans carried a flaw. Tuition inflation would likely always exceed the investment returns that Utah could earn on the premiums it collected, and a funding gap would develop. Eventually, the state would owe more money in benefits than it could pay. Today, just 12 states offer prepaid tuition plans, down from about 20 several years ago, according to CSPN.

“We kind of held back and watched, and then we saw the first one or two actual savings programs initiated, and we thought that’s obviously the way to go. We needed to get a tax-advantaged savings program established so that people could save for college education and accumulate some funds that would be available when their kids got old enough to go to college,” Alter said.

Fitting in families

Because many young Utah families do not have a lot of spare dollars to put aside for college, extremely low fees would be essential for a Utah plan to succeed, said Stephen Nadauld, a former president Dixie State University in St. George, Utah, who has served on the board overseeing my529 for nearly 25 years.

“We also wanted a plan that would have low minimum initial and continuing (contributions), so somebody could put in $50 or $100 anytime they wanted,” Nadauld said.

House Bill 1003, legislation that enabled the state to set up my529, was introduced by former Utah state Rep. Doug Peterson during a 1996 special legislative session. The law became effective July 1 of that year, and on November 1, then-Gov. Mike Leavitt set the plan in motion at a press conference in a kindergarten class at Bennion Elementary School in Salt Lake City.

my529 was thereby formed, to perform the financial service of managing investment funds for educational savings of students.

Options expanded

At the outset, account owners had one investment choice: the Public Treasurers’ Investment Fund managed by the Office of the Utah State Treasurer, which Alter ran at the time. The interest rate environment in 1996 was relatively high, and the Public Treasurers’ Investment Fund’s rate of return averaged between 6% and 8%. Over the previous 10 years the average had been 5.5%, “so it was at least decent,” Alter said.

In 1999, my529 introduced several investment options that consisted of Vanguard stock and bond index funds. Vanguard was the obvious choice for my529. Alter’s office already had a long-standing relationship with the investment management company.

“I had state land funds that were already invested in Vanguard,” he said. “And I said, ‘If you (my529) want to piggyback on that relationship, I’ll take the money up to the treasurer’s office, and I’ll invest it alongside the state land fund money already invested in Vanguard funds.’ So we did that.”

The move worked to the benefit of my529’s growing base of account owners. Because the treasurer’s office already had a lot of state money invested with Vanguard, my529 account money could be invested at a lower cost and take advantage of the combined size of investments held by Utah entities. The savings were passed to account owners through lower account fees. The arrangement continued until my529 direct investments in Vanguard funds were large enough to qualify for Vanguard’s lower fee structure by themselves without piggybacking onto the state’s investments.

Tax advantages and growth

Alter said the federal tax deferral benefit, which gave 529 plans an investment advantage, was vital to the success of my529. Deferring taxes on interest earnings allowed account balances to grow faster. The benefit was so important that it eclipsed the value of the Utah state income tax deduction parents could take on contributions up to a certain amount in the first years of the plan.

“If you have to pay taxes on the earnings every year, it just bleeds (the investment) dry. The (deferral) was key,” he said.

At the close of 1999, my529 had grown to $2.5 million under management in 1,100 accounts. Utah’s 529 plan was poised to grow as it entered the 21st century. Due to its investment options, low fees, and strong management, my529 would soon draw interest from influential consumer experts and attract thousands of new customers that would make it one of the most sought-after college savings plans in the country.

Only five years old at the start of the new millennium, my529 was about to enter a period of growth that would propel it to become one of the largest plans in the 529 college savings plan industry.

Depending on who was viewing the numbers at the time, the signs that my529 was poised to get much bigger were — or weren’t — already evident. Between 1999 and 2000, assets under my529’s management surged from $2.5 million to $19.3 million. The number of accounts jumped from 1,100 to 4,500.

Impressive as the gains were, the numbers were small. Yet they signaled that consumer acceptance of my529 was catching on.

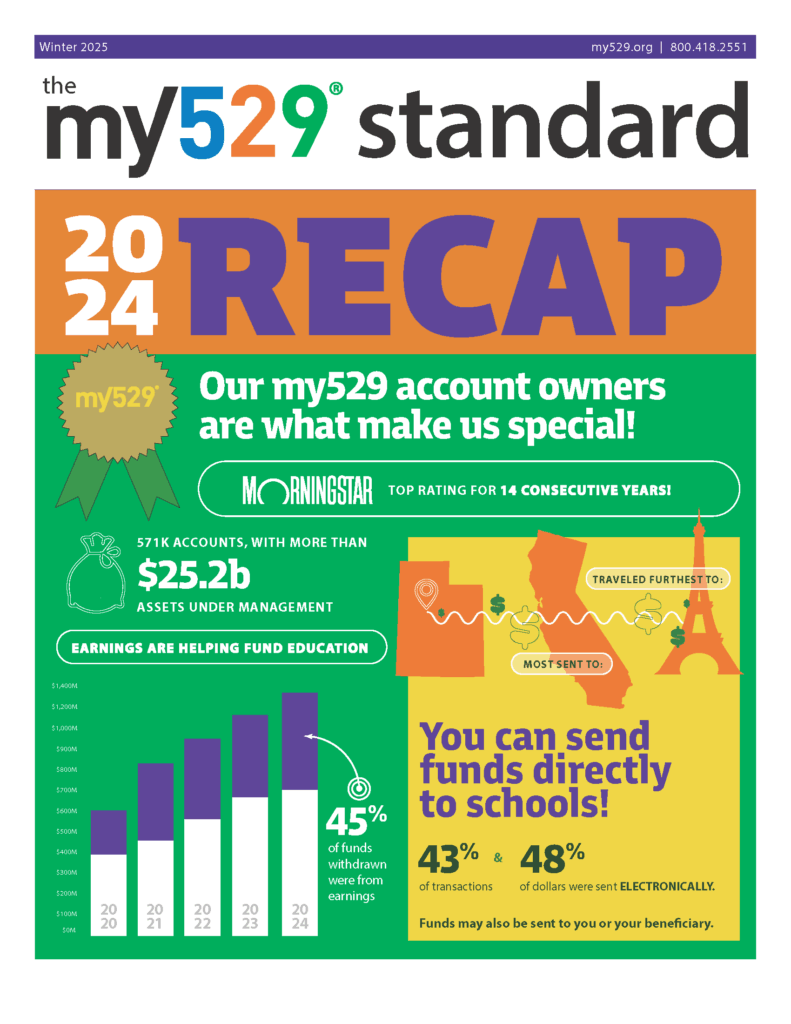

In 2010, a decade later, my529-managed assets stood at $3.8 billion in 172,200 accounts. Twenty years after the Utah Legislature established Utah’s official 529 plan in 1996, my529 assets totaled more than $8.7 billion in more than 300,000 accounts.

National recognition

Key to understanding why my529 has grown to a size that proponents of a Utah 529 plan never envisaged in 1996 is the favorable response to my529 initiatives and innovations by investment experts and consumer writers. my529’s strong performance brought priceless national exposure, Alter said.

“And we always got the highest rankings that were possible from any of those sources because of several factors,” he said.

The decision to offer passively managed, indexed investments that track the markets instead of actively managed mutual funds, which can do better or worse than the markets, showed my529 was different from most 529 plans. Alter said many rival plans started with actively managed mutual funds that underperformed the market and made the plans unappealing to investors.

Another choice that set my529 apart was to offer indexed investments managed by mutual fund giant Vanguard.

“We were the second state to establish a relationship with Vanguard and to offer them as a 529 product. That kind of gave us a head start on everybody,” Alter said.

Lower costs, more savings

Having a low fee structure was important, too. Because indexed funds run more or less mechanically, they are less expensive than actively managed mutual funds, which tend to be more expensive to manage on a daily basis. That means my529 account owners whose investment options include passively managed, indexed mutual funds may pay lower fees than those who invest in actively managed mutual funds.

“A low fee structure over time is one of the most important factors you can have, and so that was a big driving factor” in my529’s growth, Alter said.

More investment options and gifting

Continuing to diversify its offerings, my529 added a cash-equivalent investment option in 2009 that included a federal guarantee through the Federal Deposit Insurance Corp. (FDIC). my529 was the first 529 plan to incorporate FDIC-insured accounts into age-based investment options and was the first — and remains the only — plan to offer a customized age-based option.

Seeking another significant fund manager to pair with Vanguard, UESP added Dimensional Fund Advisors in 2013. Dimensional is an enhanced passive index fund manager. Account owners can blend Vanguard and Dimensional funds in my529’s customized options.

my529 also has worked to make the plan more dynamic by increasing and simplifying ways account owners can contribute — electronically, scheduled contributions, payroll deduction, even allowing a direct deposit of Utah state income tax refunds.

my529 continued to innovate in 2014 when it launched its Gift Program. Account owners can share a secure gifting code to encourage family and friends to contribute.

Adding stable value

In August 2018, my529 added a stable value option to its underlying investment offerings. The PIMCO Interest Income Fund is an underlying investment in some Target Enrollment Date portfolios and some Static options. The fund also is available as an option to owners of Customized Age-Based and Customized Static accounts who design their own investment allocations.

The PIMCO Interest Income Fund focuses on preserving principal and providing liquidity while generating a steady return to families who are saving for higher education. The fund is invested in high-quality government and corporate bonds with short- and intermediate-term maturity dates.

Materials available in Spanish

In November 2018, my529 made some materials available in Spanish. The my529 website, Program Description, enrollment forms, and other resources in Spanish are located at my529.org. The effort is part of my529’s commitment to reach a wider audience regarding the importance of preparing for future education.

College planning resources

In February 2019, my529 started working with Invite Education to make college planning materials available. Visitors to my529.org can access a free, comprehensive College Savings Estimator to help assess how much they need to save for higher education costs.

First option phased out

my529 closed the Public Treasurers’ Investment Fund (PTIF) investment option on July 11, 2019. Investments in the Public Treasurers’ Investment Fund investment option moved to the FDIC-Insured investment option. Within the customized options, investments in the Public Treasurers’ Investment Fund also shifted to FDIC-insured accounts.

The Public Treasurers’ Investment Fund, an underlying investment managed by the Utah State Treasurers’ Office, was the first investment offered by my529 in 1996.

A change in leadership

A big part of my529’s success has been the steady hands of its leadership over recent decades. Taking over in 2004, Executive Director Lynne Ward oversaw tremendous growth and guided my529 to national industry prominence. Under Ward, my529 grew from a small plan to the third-largest direct-sold plan in the nation, and more than doubled the staff working to help families save for higher education expenses.

In 2019, Richard Ellis took the helm as Executive Director. Former state treasurer of Utah, Ellis had been with my529 since November 2015. Strong growth continued under Ellis, as he introduced a bevy of changes to help carry my529 into the future. Under Ellis, my529 introduced the Net Asset Value valuation of investment options, began reporting the personal rate of return for individual accounts, and also rolled out the ability to send direct electronic payments to participating schools. Additionally, during Ellis’ tenure my529 transitioned from age-based investment options to a Target Enrollment Date investment option, while also revising the lineup of the plan’s Static investment options.

In 2025, Mark Cain took the helm at my529, marking the next chapter in my529’s history. Prior to taking the position, Cain was the deputy executive director for Utah Retirement Systems, where he’d been involved in all aspects of operations, administration, pension systems, savings plans and more, including internal audits and investment compliance.

“It’s an honor and privilege to serve as the next executive director of my529,” Cain said during the changeover. “Through the mission, vision, values and extraordinary employees, my529 is one of the top plans in the country for helping families save for education. I’m humbled to have the opportunity to be part of this wonderful organization, and I look forward to the continued growth and success of my529 in the future.”

Eligible expenses expand

The SECURE (Setting Every Community Up for Retirement Enhancement) Act, signed into law on December 20, 2019, expanded qualified higher education expenses to include repayment of qualified education loans. It also permitted 529 funds to cover registered apprenticeships.

The new law approved the use of account funds for the repayment of qualified education loans — including amounts paid as principal or interest — for the beneficiary, or a sibling of the beneficiary. Beneficiaries can use no more than $10,000 in withdrawals from all 529 accounts to pay down the loans. Distributions from 529 accounts to a sibling also have a $10,000 limit.

Apprenticeships must be registered and certified with the U.S. Secretary of Labor under Section 1 of the National Apprenticeship Act to be considered a qualified expense.

In 2025, eligible expenses expanded even further with the passage of H.R. 1 by the 119th US Congress. Provisions in the legislation allowed for new uses of 529 funds for K-12 education, use of 529 funds for qualified postsecondary credential programs and removal of the expiration date for ABLE fund rollovers.

$29 billion in assets under management

By December 2025, my529’s assets under management topped $29 billion, a milestone capping nearly 30 years as Utah’s official and only tax-advantaged 529 college savings plan, as well as the third-largest direct-sold 529 plan in the nation.

600,000 accounts served

Alongside this achievement, my529 also recently crossed the threshold of 600,000 accounts, approximately doubling in size from 2010. The accounts, with account owners and beneficiaries distributed throughout Utah and the United States, represent a growing number of families who choose to invest in Utah’s educational savings plan to save for education costs.

The future is what matters

my529 is focused on consistently innovating and improving what we offer to investors.

Utah’s plan has earned the top industry rating for the past 15 consecutive years from Morningstar, an independent investment research firm.

What drives my529 is not accolades, however, but a desire to serve our account owners as they save what they can, when they can to build a bright future for their beneficiaries. Our plan is your plan, and your future is our future.