my529 passes savings from share class change to account owners

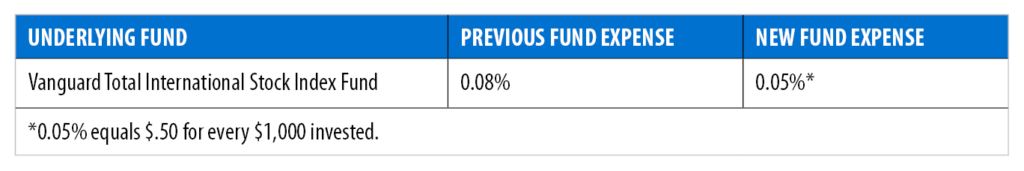

A Vanguard fund featured in many my529 investment options qualifies for a new share class as of May 2, 2024, dropping its underlying fund expense by three basis points.

my529 is passing the savings on to its account owners. Currently, 78% of account owners are invested in a my529 investment option that features the Vanguard Total International Stock Index Fund (VTPSX). my529 estimates that these account owners will collectively save more than $947,000 annually.

The total value of the my529 Trust’s assets invested in the underlying fund has surpassed $3 billion, a threshold that qualifies my529 for a lower-cost share class.

Due to the share class change, VTISX is now the ticker symbol for the Vanguard Total International Stock Index Fund.

Advantages of pooling investments

my529 pools together the money from account owner contributions and invests it in underlying investments. my529 owns these underlying investments in a public trust. Account owners do not own the underlying investments, but instead own units in the my529 investment options offered by the trust. The daily value of a my529 investment option unit is the pooled value of its underlying investments minus the daily accrual of expenses.

Pooled investments in the Vanguard Total International Stock Index Fund recently qualified for a less-expensive share class. Account owners invested in the fund through my529 will now pay an average of 58% less than what a retail investor would pay for the same fund.

my529 consistently looks for opportunities to reduce costs for account owners. With the shift to VTISX, my529 qualifies for the lowest-cost share class available for 18 out of 20 Vanguard funds used in my529 investment options.

Passing on savings to you

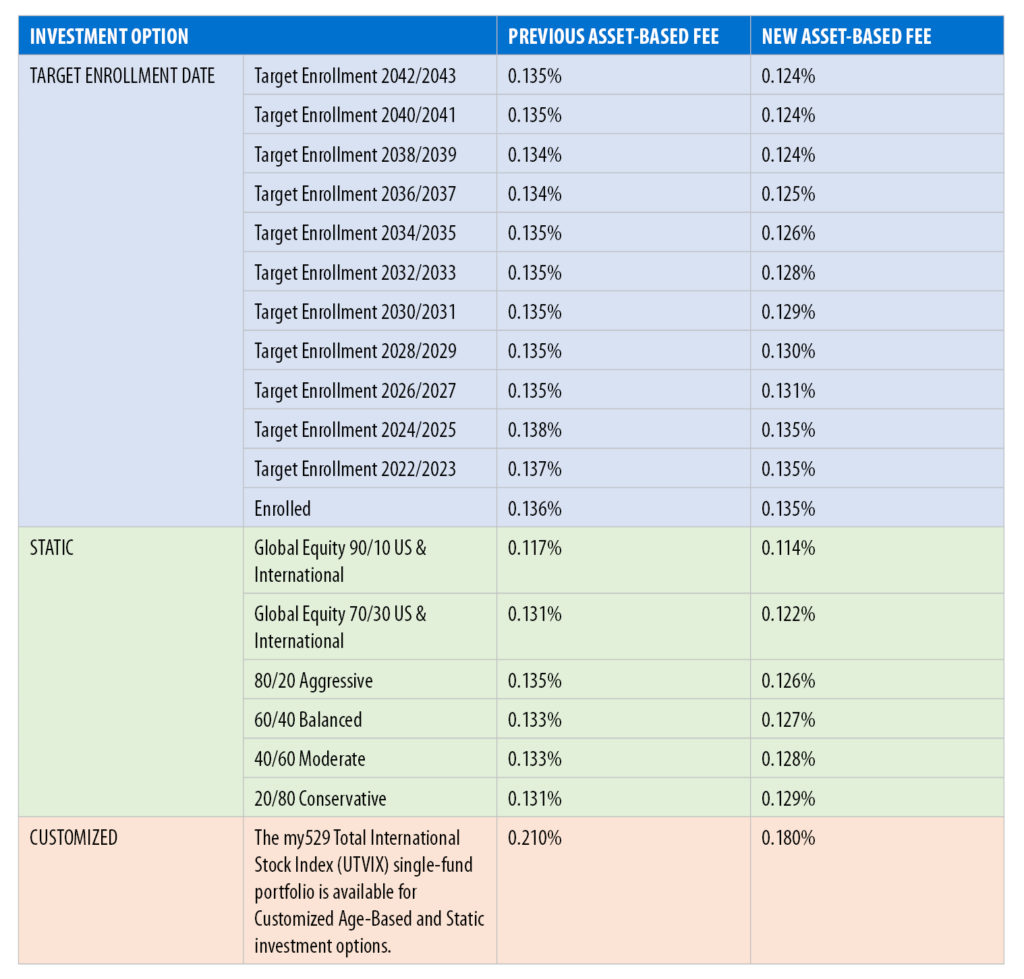

The fund appears in all 12 my529 Target Enrollment Date portfolios, as well as in six Static investment options. The fund is available as a single-fund portfolio in the Customized investment options, the my529 Total International Stock Index (UTVIX).

The reduction in underlying fund expenses lowers the annual asset-based fee, increasing the potential for growth for account owners. Refer to the my529 fee tables for more information.

“Vanguard has been a trusted fund partner with my529 since the late 1990s,” said Richard Ellis, my529 executive director. “Their team shares our values─offering high quality funds at the lowest possible cost. We explore every avenue to pass along savings to the investor.”