What to do if a my529 account owner dies

Helping your clients manage the financial aspects of a loved one’s passing can be a difficult task. If the deceased was a my529 account owner, these steps need to be taken to ensure a smooth transition and to protect the funds in the account.

1. Notify my529:

The first step is to notify my529 of the account owner’s death by calling 1-800-418-2551 about the account owner’s death. An account specialist will guide you through the necessary steps to transition the account to a new account owner and provide you with the required paperwork. my529 will send a letter to the successor with instructions to assume ownership of the account.

2. Provide the necessary documentation:

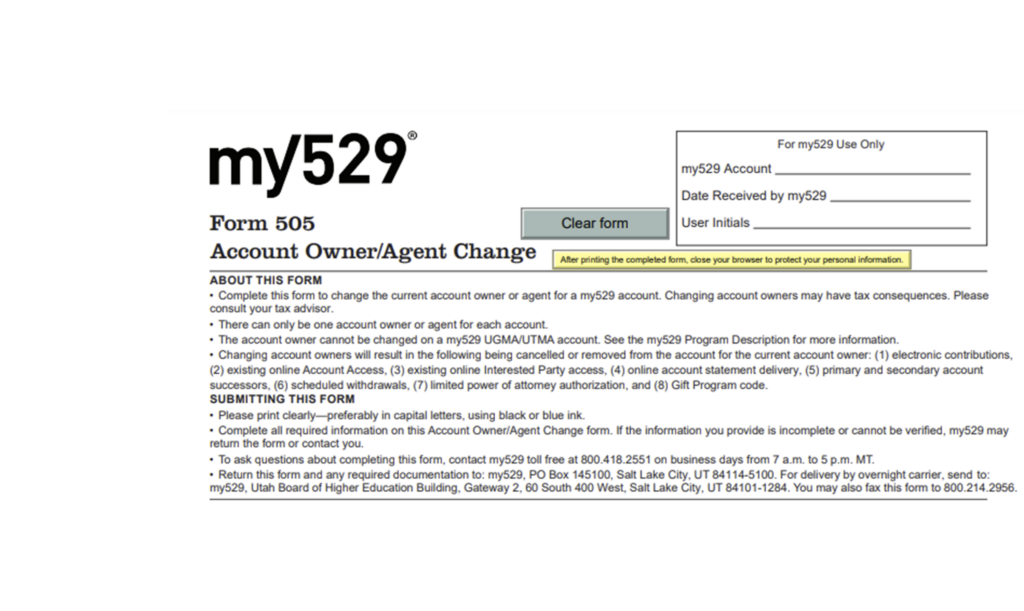

The successor of the account will need to provide the death certificate and the Account Owner Change paperwork, Form 505. Because the limited power of attorney (LPOA) authority will be removed with the change of account owners, the new account owner will have to submit Form 710 to re-establish the LPOA.

3. Transfer the account:

Once my529 receives the appropriate paperwork, the account will be transferred to the new account owner. This process is known as a change of ownership.

If the successor declines ownership, or there is no successor on the account, and the beneficiary is a minor, then the account becomes a UGMA/UTMA and an agent will need to be added to the account. The agent on an UGMA/UTMA account may be the parent or guardian of the minor account owner. See the Program Description for further details. If beneficiary is age of majority, they can become the account owner. Check to see if your clients’ accounts have successors. As the financial advisor, you can make this process a smooth transition by submitting the Form 515 to designate a successor.

If you have any questions about tax implications, speak with a tax advisor.